Budget 2025: Your Tax Tables and Tax Calculator

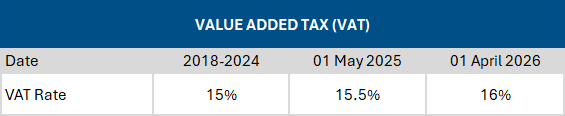

Budget 2025, if adopted by Parliament, will effectively bring about an increase in personal income tax by not adjusting the tables for tax rates, rebates and credits, while also implementing substantial increases in ‘sin’ taxes and introducing a 0.5% VAT increase on 1 May 2025 and another 0.5% increase effective 1 April 2026.

This selection of official SARS Tax Tables and other useful resources will help clarify your tax position for the new tax year.

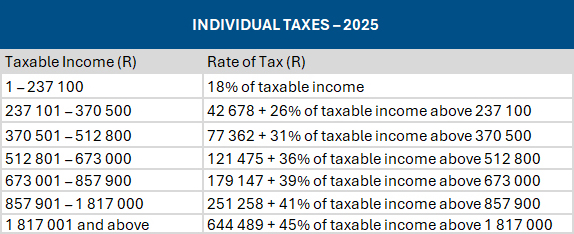

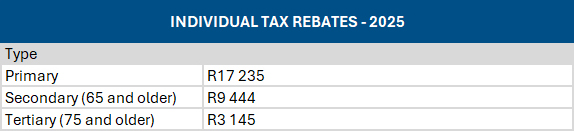

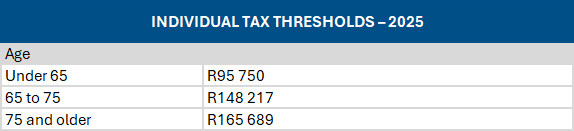

Individual taxpayers: Tax tables unchanged since 2023

Source: SARS

Source: SARS

Source: SARS

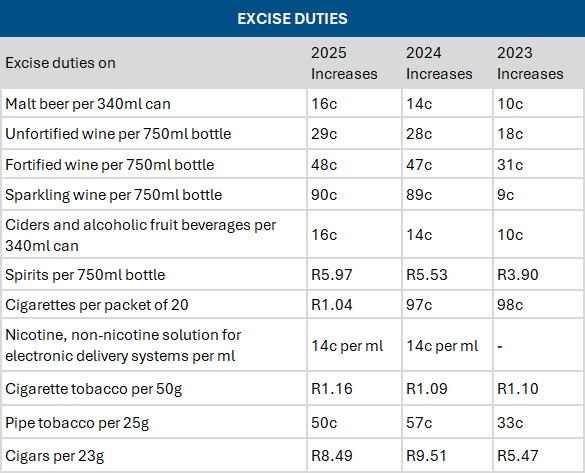

Sin taxes raised

Source: Adapted from Budget 2025 People’s Guide

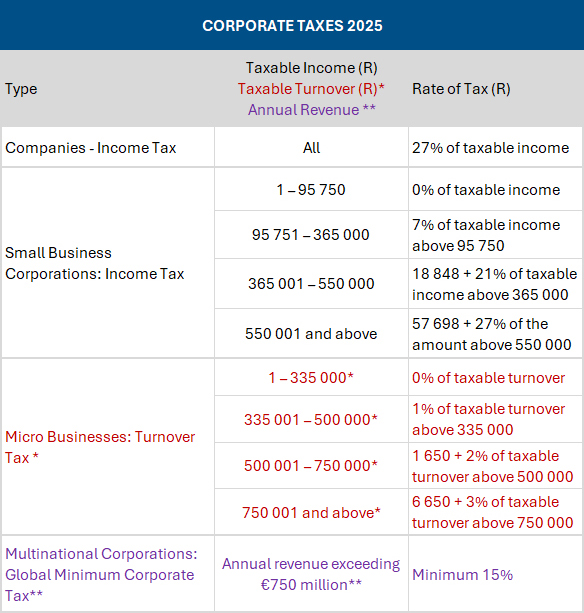

Businesses: Corporate tax rates unchanged

Source: Adapted from SARS Budget Tax Guide 2025

Proposed VAT increases

Source: Adapted from Budget 2025 People’s Guide

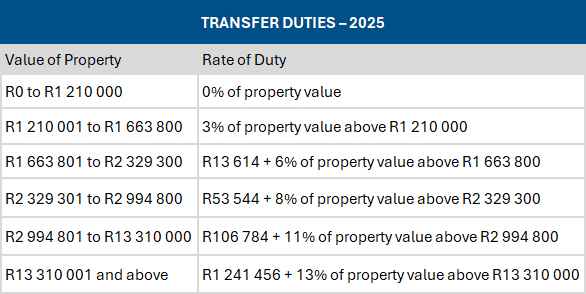

Transfer duty: 10% upward adjustment from 1 April

Source: SARS’ Budget Tax Guide 2025

How much will you be paying in income, petrol and sin taxes?

Use Fin 24’s four-step Budget Calculator here to find out the monthly and annual impact on your income tax, as well as what you will be paying in fuel and sin taxes.