“Good fortune is what happens when opportunity meets planning,” – Thomas Edison

You have your idea, you have your mission statement and perhaps you even have an idea of who your first customers will be, but there are still a few things you should consider doing before you launch your company. When it comes to your finances doing these five things in advance will ready you and your business for success and allow you to focus more on the company and less on the necessary financial administration.

Deal with your personal finances

For some entrepreneurs starting a company is seen as a way to get themselves out of financial trouble. Unfortunately, if this is the case, the company will be starting off on the back foot. If your motivation for starting a business is as a way to repay your own loans or debts, then you won’t be making the best decisions for the company. Ideally, your finances should be clean with debts paid off and taxes up to date. This will allow you to focus on the company for what it is, rather than on what you need.

Ideally, you will be starting your company with your own personal finances sorted for the first six months at least, and with no debt. If you are in trouble, or don’t have any savings, then it is important that you get any loans and debts under control and reshape your personal expenses in line with leaner times before you take your first new business step.

Consolidate any debts you may have and arrange for lower monthly payments. Cancel any unnecessary services and costs and try to get your monthly outgoings as low as you can before you quit your job or start your company. You are going to have tough months and it’s important that you are ready to weather them if you hope to succeed.

Open a business account

Many new businesses begin as extensions of the owner. Sometimes the owner’s finances are used to pay for business expenses and these costs get lost along the way in the search for success. It is therefore important to decide on a vehicle for your business (ask your accountant to advise you on whether you will be best off with a company, trading trust, or sole tradership) then open a business banking account to more accurately keep track of exactly what is owed by your business to you, or you to your business. All relevant business expenses are tax deductible, but this can’t happen if they aren’t accurately tracked and accounted for in the business. Opening an account will help you not only look more professional but also track your income and outgoings more effectively.

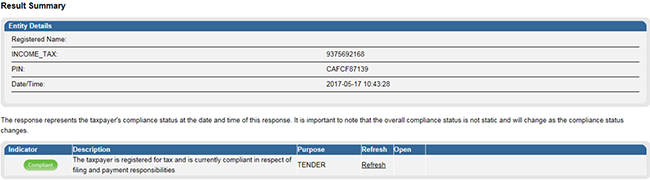

Get your taxes up to date

Your personal taxes are an important aspect of business leadership. If your taxes are not properly filed and up to date when you have a job, the chances are they are only going to get worse. Ask your accountant to look at your personal situation and ensure everything that is owed is paid and signed off.

The good news is that at the same time you can also ask your accountant to look at your business and advise you on how best to structure things to get the most from the money you are earning. In the early days, every cent is going to count, and you will want to wring every benefit possible out of the company to get it launched. You don’t want to be paying more tax than you are required to.

Take a basic finance course

Everything these days can be learnt online. Whether you take a formal course or watch a series of YouTube videos, it is highly advised that you learn the basics of finance, especially if you have never worked in that department before. While working with your accountant is an important step when starting any new endeavour, it is also important that you understand the basics of what is going on day-to-day when it comes to pricing, sales, expenditure, profit and loss. Without this knowledge you won’t be able to make the important decisions that can make or break a company.

Set up automatic invoicing

Many small business owners opt to use Word and Excel invoice templates when starting out, but these require manual entries, can be time consuming and are difficult to track. A recent study also revealed that 39% of invoices are paid late and 61% of late payments are as a direct result of invoicing errors.

Do you know which invoices have been sent out, which have been paid and which are outstanding? There are many automated invoicing systems, which will take the worries out of invoicing and allow you to track payments and due dates. This in turn helps you to keep track of cash flow and ensure that you always have the money necessary to pay your expenses.

Invoice automation systems can also offer automatic reconciliation, generate recurring invoices and even capture data on expenses from photographs of receipts. Importantly you can also generate automatic reminder emails to chase up payments and make your monthly payments automatically, too. The time and stress savings are enormous and at the end of the day you will be able to hand over organised and presentable books to your accountant, enabling them to file taxes and notice potential areas for savings more easily.