Businesses: How to Survive the Coronavirus Panic

“Never let a good crisis go to waste” (Winston Churchill)

Globally, the COVID-19 coronavirus has spread panic amongst societies and markets. Businesses are suffering their most challenging times since the 2008 Global Financial Crisis.

This is the time for urgently reviewing how events have affected your business and how you can respond to the seeming chaos.

Cash is king

When faced with great uncertainty, conserve cash and shore up all your credit lines. This will give you greater flexibility when strategizing a response to the coronavirus. You may, for example, be able to buy a crucial stock item for a discount from one of your suppliers, thus ensuring that you can continue operating. Apart from strengthening your position with your competitors, this could help the supplier to remain in business – relationships are important, and this supplier will be grateful to you.

Trim costs wherever you can – some of this is being done for you as many companies are cancelling travel, resulting in many meetings and conferences being called off. Capital expenditure is being pruned globally and there may be opportunities to delay some of your current capex.

Keep your staff healthy

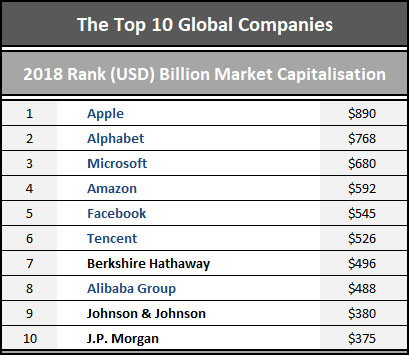

Apple has already told staff to work from home to reduce the risk of catching or spreading the coronavirus. Desks are being spaced to reduce the possibility of catching the virus and meetings are being cancelled or are taking place electronically.

Make sure the risk of staff catching the virus is minimised and have a succession plan if some key members are incapacitated by the coronavirus. Take particular care of staff members who have health issues, as they could become seriously ill or die if they catch the virus. As health authorities are advising people to frequently wash their hands, ensure that you have enough hand washing dispensers.

As many of your staff will be working from home using smart phones and their own desktops, have your IT department mitigate the risks of hacking or computer viruses getting into your IT platform.

Perhaps, most importantly, communicate often with your employees and managers. Regularly follow updates from the World Health Organisation and the local Department of Health. This is a time of uncertainty, as there is no definitive knowledge on how the coronavirus will evolve and thus sharing the information you gather on the disease, will improve the health and morale of staff in your business.

The Occupational Health and Safety Act imposes obligations on employers to provide a healthy environment for their staff. Much of the above is in line with ensuring that you comply with that Act’s requirements, but you need to ensure your organisation is compliant with the legislation.

Your supply chain

This is clearly a key area and working out the risks of suppliers and contractors being unable to supply you is a key task. Some of the important areas will be changing your safety stock holdings, reviewing your contracts with stakeholders and assessing the risks and the consequences of default. This is where it really pays to have cash.

As we said above, keep in mind the long term relationships with suppliers.

You also need to review your insurance policies – will they pay out if certain scenarios unfold? Do you need to take out different policies?

Reacting, planning and preparing strategies will ensure you have the agility to ride out this crisis and may even strengthen your position with competitors.