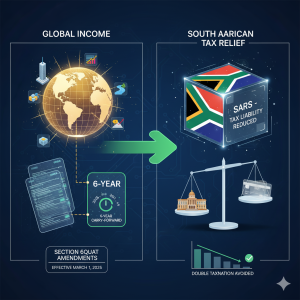

The New Normal for Foreign Tax Credits: Key Section 6quat Changes (South Africa)

South African taxpayers with foreign income or investments will benefit from crucial amendments to Section 6quat of the Income Tax Act, which provide greater relief against international double taxation. These changes, primarily focused on the carry-forward of unused credits and the treatment of foreign capital gains tax, are effective from March 1, 2025 (the start of the 2026 year of assessment for individuals).

Part 1: Detail of the Section 6quat Amendments

- Introduction of the Foreign Tax Credit Carry-Forward (Up to 6 Years)

This is the most significant change, moving away from the “use-it-or-lose-it” system:

| Aspect | Pre-March 1, 2025 | Post-March 1, 2025 |

| Treatment of Unused FTCs | Any foreign tax credit (FTC) that exceeded the South African tax liability for the year was generally lost. | Unused FTCs can be carried forward automatically by the South African Revenue Service (SARS). |

| Carry-Forward Period | Not applicable. | The unused credit can be carried forward for up to six subsequent years of assessment. |

| Applicability | Affects companies from the 2025 tax year and individuals/trusts from the 2026 tax year (commencing March 1, 2025). |

This amendment ensures that taxpayers will be able to fully utilize foreign taxes paid, even if South African taxes on that income are lower or if the income fluctuates between tax years.

- Full Utilisation of Credits on Foreign Capital Gains

The legislation has been modified to address the calculation of FTCs on foreign capital gains:

- The Change: Taxpayers are now permitted to fully utilise foreign tax credits for the taxes paid on capital gains in a foreign jurisdiction.

- The Benefit: This eliminates the previous restriction where the FTC for capital gains was limited only to the portion of the foreign tax credit attributable to the taxable portion of the gain (i.e., the portion included in South African taxable income).

This means the FTC can be used to the same extent for the taxes paid in South Africa on the same gains, providing fairer double tax relief.

Part 2: Compliance Steps for Taxpayers

The carry-forward mechanism is largely automated by SARS, but taxpayers must ensure correct disclosure and retention of records to benefit fully.

| Compliance Step | Action Required by Taxpayer | Rationale for Compliance |

| 1. Accurate Return Submission | Fully and accurately declare all foreign income and the corresponding foreign tax paid in the relevant section of the ITR12 (for individuals) or ITR14 (for companies) tax return. | SARS’s system relies on this input to correctly calculate the Section 6quat credit and the six-year carry-forward amount automatically. |

| 2. Documentation | Retain verifiable proof of foreign tax paid (e.g., foreign tax assessments, official tax receipts, or tax certificates). | In the event of a SARS verification or audit, this documentation is essential to prove the claim and prevent the disallowance of the credit. |

| 3. Assessment Review | Carefully review the Notice of Assessment (ITA34) received from SARS. | Ensure the correct FTC has been applied and that the unused foreign tax credit balance has been correctly carried forward and reflected on the assessment. |

| 4. Tax Residency Status | Verify current tax residency status in South Africa, especially for expatriates. | The entire Section 6quat mechanism only applies to South African tax residents taxed on their worldwide income. |

Final Note

These amendments, effective from March 1, 2025, significantly improve the South African tax system’s relief for double taxation, particularly for international investors and those with sporadic foreign capital gains. Taxpayers are encouraged to consult a tax professional for assistance with complex international tax matters.