Budget 2022: Your Tax Tables and Tax Calculator

How much will you be paying in income tax, petrol and sin taxes? Use Fin 24’s four-step Budget Calculator here to find out.

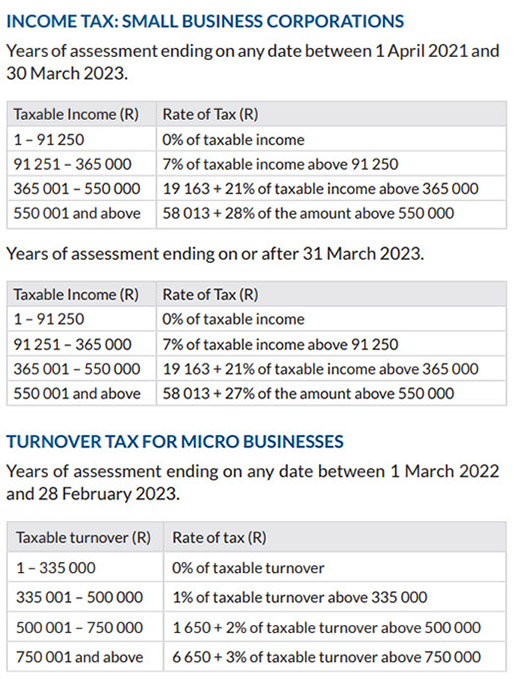

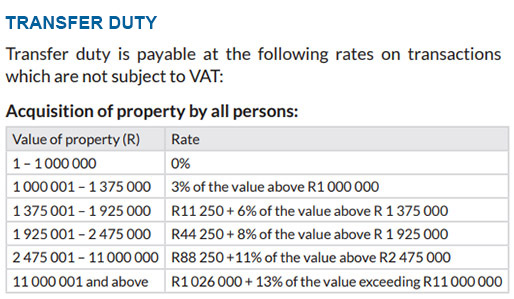

Have a look at the tax tables below for the new Individual and Special Trust income tax brackets, and for a convenient reminder of the various other taxes that remain unchanged –

Multiple Income Streams? The PAYE Dangers and a New Option for Pensioners

“Every advantage has its tax.” (Ralph Waldo Emerson)

An unfortunate reality for many non-provisional taxpayers with multiple income streams is a large and unexpected tax liability following a year-end tax assessment – even though PAYE was paid each month on their income streams.

Taxable income streams include salaries and wages, allowances, pensions and retirement annuities, rental income and investment income. Many taxpayers have multiple income streams: a common example is a pensioner receiving two pensions paid by two different administrators; or receiving both a pension and a retirement annuity. Other examples would include a person holding two part-time positions, or receiving both a pension and a salary, such as a widow who is employed but also receives a deceased spouse’s pension.

In all of these and other cases where taxpayers who receive income from more than one source of employment, pension, or annuity, the employees’ tax (PAYE) deducted by the respective employers or retirement funds may not be enough to cover their final annual tax liability assessed at the end of the year.

How can the PAYE deductions not be enough?

Because SARS calculates tax liability annually on assessment, a taxpayer could well face an unexpected and large tax liability, even after having paid PAYE every month on various income streams.

This is because the South African tax system requires adding together all sources of income of a taxpayer into a single total sum, which then determines the tax rate which applies to all the income combined.

So, the more the total income from all sources, the higher the tax rate and the more tax due.

By deducting PAYE every month, employers or retirement funds assist taxpayers to pay their tax liability in advance over the year. When only one employer or retirement fund is involved, the total PAYE deducted monthly should be equal to the tax liability on assessment, leaving no extra tax due on assessment.

However, where more than one employer or retirement fund is involved, each will deduct the correct amount of PAYE on only the salary or pension/annuity they each pay. In addition, each will also independently apply the rebates the taxpayer is entitled to.

When all the sources of income are added together during the year-end assessment, and any rebates are applied only once, the total income often pushes the taxpayer into a higher tax bracket. Applying this correct and higher tax rate on the full amount then results in an additional amount of tax to be paid on assessment.

In practice

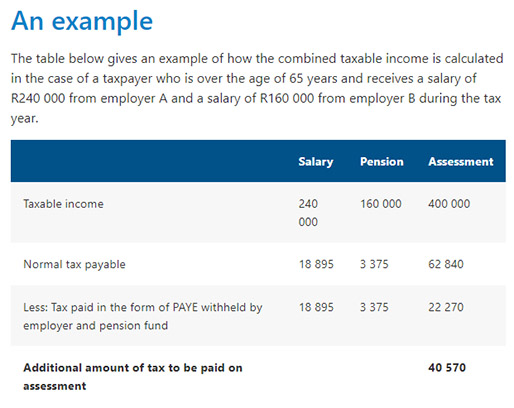

The “pension plus salary” example below illustrates just how much more the tax payable on the total combined income assessed at the end of the year could be than the PAYE paid on each separate income stream during the year.

The taxpayer in the example will face an additional R40,570.00 tax liability on assessment, because although a total tax of R22,270.00 had already been deducted by way of PAYE paid during the year, it was too little to cover the full annual tax liability of R62,840.00.

Large, unexpected tax debts such as this often lead to delayed payments and therefore penalties, further burdening the taxpayer.

How to avoid the problem

Taxpayers with multiple income streams, who are at risk of a large tax liability when the annual income tax return is assessed at the end of the tax year, need to have more accurate monthly amounts of PAYE deducted.

Fortunately, the Income Tax Act allows these taxpayers to make additional voluntary tax payments by making a written request to their employers, insurance companies and/or retirement fund administrators to deduct additional monthly PAYE.

To voluntarily pay more PAYE, you have two options –

- The first option involves applying a single percentage at which PAYE should be deducted by all employers and retirement funds that pay a salary or pension/annuity to you.

- The second option is to increase the amount of PAYE deducted by one or more employers or retirement funds but is more complex to calculate.

Either way, professional assistance is highly recommended. Ensuring that more appropriate amounts of PAYE tax is deducted during the year will eliminate surprises and ease the financial burden when submitting annual tax returns at the end of the tax year.

Pensioners – a new option for you from 1 March

Not many pensioners are currently making use of this option but, fortunately, recently introduced legislation has enabled SARS to provide them with a new service from 1 March. Using the latest data available to it, SARS will determine a more accurate PAYE deduction amount for pensioners with multiple income streams, and then automatically provide their retirement fund administrators with this new PAYE deduction percentage. This will allow a more accurate amount of PAYE to be deducted from pensions or annuities payable from March 2022. The rate will be valid for the entire tax year unless the taxpayers’ circumstances change. However, you can request retirement fund administrators to rather use the normal PAYE deduction rate, or to deduct PAYE at an even higher rate than the increased rate provided by SARS.

SARS Makes SMME Tax Compliance Easier

“Tax complexity itself is a kind of tax” (Max Baucus)

NOTE: Bear in mind that although many of the resources mentioned below are addressed by SARS to you as a private taxpayer, there is just no substitute for professional advice and assistance when it comes to matters of tax.

“SMME Connect # 1”, the January issue of a new SARS newsletter for SMMEs available here, has focused on the issues around tax compliance in the sector. In the letter SARS acknowledges problems around the pandemic that lead to increased difficulty for SMMEs attempting to meet their tax obligations saying, “We acknowledge that the COVID-19 pandemic has impaired our ability to be physically ‘At Your Service’ as we had to limit the number of taxpayer visits at SARS branches and promote digital channels”. It adds, however, that the bulk of the problem comes from the fact that business owners in the sector either find their obligations difficult to understand, or are not aware of their obligations, and just what is required of them.

In acknowledging the problem SARS has also stated that its direct aim is to make the processes simpler, increase knowledge around requirements and ultimately to bring all SMMEs up to date on their tax compliance. This is what the letter, aligned with a new initiative called Vision 2024, sets out to correct.

Aligned with “Vision 2024”?

In March 2020 SARS introduced their new Vision 2024, which they said was an attempt to update the goals and services of SARS in order to improve efficiency and their ability to collect owed taxes.

“Our Vision 2024 is to build a smart modern SARS with unquestionable integrity admired by Government and public and our international peers. We proceed from the base that all taxpayers are honest and if we make it easy and seamless, compliance will increase simultaneously,” SARS said in a statement at the time.

In line with this, SARS’ new newsletter endeavours to not place blame for past non-compliance. The issue in fact begins with a number of startling stats on the SMME sector in the time of the pandemic. SARS says “95% of SMMEs reported a decrease in revenue attributed to the consumers’ inability to earn income” and that “90% of SMMEs are either struggling or temporarily closed”. The purpose of these stats is for SARS to say, “We understand your plight and aren’t out to get you.” It goes on to state that “When you comply with your tax obligations, you place your business at an advantage by eliminating the potential cost of non-compliance and administrative penalties.”

What are the changes?

In order to simplify the system and make it easier for SMMEs to meet their tax obligations SARS has introduced a number of new measures, initiatives and system upgrades.

The first step is to confirm your “tax compliance status.” This can be done by acquiring a tax compliance pin. The process for doing this is illustrated on a simple YouTube video. The pin can then be used by your accountant over the next 12 months to verify your compliance status.

In addition, SARS has also introduced an online query system designed at assisting taxpayers to raise queries with SARS without going into a SARS branch or calling the contact centre. The query system allows taxpayers to fill in a form and, amongst other things, request a tax number, submit supporting documents, submit a payment allocation, report new estate cases, register a tax representative, make tax compliance status requests and verify tax compliance status.

SARS has also introduced a new “Enhanced Debt Management” process, which will allow taxpayers to arrange debt repayments directly through eFiling for four separate tax types: Personal Income Tax, Corporate Income Tax, Value-Added Tax and Pay-As-You-Earn (PAYE). Previously, taxpayers could only make payment arrangements via a debt collector who had been appointed by SARS, in person at a SARS branch, utilising the debt management regional email addresses, or on the My Compliance Profile (MCP) on eFiling.

The new Enhanced Debt Management Process easily allows individuals and companies to catch up on outstanding administrative penalties and taxes from a number of different pages on the site and gives them the ability to:

- Initiate and simulate a payment arrangement, with an instalment plan of up to 36 months,

- Supply the reason for the request and preferred method of payment,

- Attach mandatory supporting documents where required,

- Submit the request if they meet qualifying criteria.

These new facilities come with a reminder for business owners to also submit their own income taxes, which are a requirement in law that can affect the business’ compliance status.

Communication and social media

Finally, SARS has also updated their communications generally, with the newsletter only being one of three communication tools to educate people on their obligations. While the best solution remains conferring with a professional for all possible tax solutions, SARS’ new YouTube channel, which covers such diverse topics as, Understanding Tax Compliance Status, Illicit Trade and Counterfeit Procedures, Value-Added-Tax, Turnover Tax, Registration, Licencing and Accreditation and more, will certainly help the modern SMME owner to better understand their responsibilities when it comes to taxes.

SARS has also encouraged SMME owners to follow the service on social media through the following channels: Facebook, Twitter, LinkedIn and YouTube.