Tax Avoidance vs Tax Evasion: Toeing the Line

“The difference between tax avoidance and tax evasion is the thickness of a prison wall.” (Denis Healey, former UK Chancellor of the Exchequer)

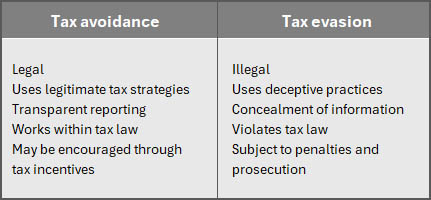

The line between tax avoidance and tax evasion can sometimes appear blurry, especially in complex transactions or fierce tax planning strategies. The comparison below is a good starting point:

What is tax avoidance?

Tax avoidance refers to legal arrangements or transactions designed to reduce or eliminate tax liability, without breaking the law.

- Moving a company into a special economic zone for the sole reason of achieving a lower corporate income tax rate.

- Timing the sale of capital assets to control the timing of capital gains and losses.

- Getting your company to pay for a motor vehicle or other expenditure as it may, depending on the circumstances, be taxed at a lower rate.

- Placing a large amount of your income into a retirement fund to obtain the highest deduction possible.

- Investing in tax-free savings accounts (this applies to individuals only).

Often termed “permissible tax planning”, tax avoidance is legal and accepted. However, when tax avoidance becomes overly aggressive or artificial (i.e., lacking commercial substance), it may cross into what tax authorities consider “impermissible” or “abusive” tax avoidance. This, while not necessarily criminal, may be challenged under anti-avoidance rules such as the General Anti-Avoidance Rule (GAAR).

South Africa employs GAAR to counteract tax avoidance strategies that exploit loopholes. These rules allow tax authorities to disregard or re-characterise transactions that have the primary purpose of avoiding tax.

What is tax evasion?

Tax evasion is characterised as the illegal act of deliberately and intentionally avoiding paying taxes, either by avoiding paying tax entirely, or by illegally reducing or deferring taxes payable. It can involve hiding or ignoring one’s tax liability by making false representations or statements, or hiding income or information that would otherwise be subject to taxation.

Examples of tax evasion include:

- Failing to file required tax returns

- Making false statements on tax returns

- Failing to declare income or deliberately underreporting income

- Claiming personal expenses as business expenses

- Over-declaring expenses, which may include falsifying invoices

- Using multiple entities without legitimate business purpose

- Moving money through multiple accounts to obscure its source

SARS uses data-driven insights, self-learning computers, and artificial intelligence to combat tax evasion, and is empowered to conduct criminal investigations into tax offences and work with the criminal justice system to prosecute offenders.

Tax evasion can result in severe penalties of up to 200% of the shortfall in tax, plus interest, and even jail sentences of five years or more.

Best practices for legal tax avoidance

- Stay updated with ever-changing tax legislation to make informed decisions.

- Structure your business operations or transactions in a manner that legally minimises taxes – for example, operating as a sole proprietorship or a private company have different tax implications.

- Engage in permissible tax planning by adhering to all tax laws and regulations, and avoiding abusive tax schemes designed to exploit loopholes in the tax laws.

- Utilise all tax deductions, credits, exemptions and incentives, including deductions for business expenses, tax credits for certain investments or activities.

- Comply with reporting requirements and avoid penalties and interest by filing accurate tax returns on time.

- Maintain accurate records of all your financial transactions and tax-related documents to ensure all claims and deductions can be substantiated when required by SARS.

- Ensure transparency and full disclosure by always providing full and accurate information on tax returns: concealing information or providing misleading details can easily cross the line into tax evasion.

Best practice as a service

By adhering to these best practices, taxpayers can effectively employ tax avoidance strategies without crossing the line into the realm of tax evasion.

5 Tips for Helping Your Employees Through a Crisis

“When people are financially invested, they want a return. When people are emotionally invested, they want to contribute.” (Simon Sinek)

Employee engagement. It determines so much about the direction of a company, its staff productivity and how likely it is to succeed. According to a Gallup poll just 23% of South African employees are actively engaged, and the support offered by your company during difficult times is a key predictor of whether your employees are doing better or worse than that. Ignoring a personal crisis or mismanaging it can result in diminished trust, high turnover, and costly legal complications. On the other hand, getting it right can transform a tough moment into a team-building exercise that drives loyalty across your enterprise. Here are our five tips for handling an employee’s crisis with care, compassion, and professionalism.

1. Listen without judgement

The first step in supporting someone through a crisis is simply to listen. Not all employees will be forthcoming, and many will fear repercussions or shame if they do share. By creating a psychologically safe environment where they feel heard and respected, you allow the conversation to unfold in a way that will allow you to help.

Listening does not mean solving. Ask what they need. Avoid overpromising or reacting too quickly. This is their experience, not yours, and your job is to provide space for them to express it.

2. Tailor your support to the individual

There is no one-size-fits-all approach. While one employee might benefit from time off, another may prefer flexible hours or a change in responsibilities. Consider what reasonable accommodations can be made, in accordance with HR policies and employment laws. What’s important is that the support feels personal and meaningful, not generic or performative. You will likely want to speak to HR or, in a smaller business, ask for outside advice.

3. Communicate clearly (and privately)

When an employee’s going through emotional turmoil, one of the most challenging aspects is managing the line between transparency and confidentiality. While you may need to inform certain stakeholders about changes in workflow or responsibilities, the nature of an employee’s crisis should never be discussed openly or speculated about in the office.

Establish clear, private channels of communication and check in regularly. Let the employee know what’s being shared and with whom – and always ask for their consent where appropriate. Trust is fragile and you need to protect it.

4. Support your other employees too

It’s not just the employee in crisis who needs help – often their direct manager, or co-workers will also be feeling overwhelmed, overworked or unsure how to proceed. Offering management training on crisis response, mental health first aid, and compassionate communication can improve outcomes for everyone involved.

Managers are on the front line of employee wellbeing, and giving them the right tools helps avoid missteps that could escalate the situation.

5. Make room in your budget for empathy

There’s no denying that crisis support can come with financial implications, from offering extra leave to making temporary hires to cover the missed workloads and even therapy for the staff member. But investing in your people always pays off in the long run. This is where your accountant becomes more than a numbers person.

Your Tax Deadlines for May 2025

- 07 May – PAYE submissions and payments

- 23 May – VAT manual submissions and payments

- 29 May – Excise duty payments

- 30 May – VAT electronic submissions and payments, & CIT Provisional Tax payments where applicable.