Planning to Cease Being a South African Tax Resident? What You Should Know Before Approaching SARS

“Dear IRS, I am writing to you to cancel my subscription. Please remove my name from your mailing list.” (Snoopy)

According to some estimates, as many as 1,900 millionaires have left South Africa over the last few years. A New World Wealth Africa report indicates that 4,200 high net-worth individuals left the country over the last 10 years.

Whether due to choice or circumstances, a taxpayer ceasing to be a tax resident of South Africa must declare the change to SARS.

As the number of wealthy and skilled South Africans who are emigrating increases, SARS recently announced that another channel has been made available to taxpayers to inform SARS as above.

You can now also inform SARS through the Registration, Amendments and Verification Form (RAV01) available on eFiling or at a SARS branch, by capturing the date on which you ceased to be a tax resident.

Alternatively, you can inform SARS by capturing the date on the ITR12 tax return, as before.

Informing SARS via any channel could trigger unintended consequences. In addition, to qualify the taxpayer will have to substantiate how the qualifying criteria are met.

Many intricacies

It is not as simple as filling in a form. Numerous factors are taken into account to determine whether a taxpayer has ceased to be a tax resident of South Africa.

There are three bases for qualification for individuals:

- Cease to be ordinarily resident

- Cease by way of the physical presence test

- Cease due to application of a Double Tax Agreement (DTA).

Whether an individual ceases to be a tax resident in South Africa is based on the manner in which such individual has been a tax resident. If the taxpayer has been ordinarily tax resident, the intention to cease will be supported by various objective factors. If a person has ceased to be ordinarily tax resident, it will be from the day such person ceased residence.

An individual, who is resident by virtue of the physical presence test, ceases to be a tax resident when that person has been physically outside the Republic for a continuous period of at least 330 full days. The individual will be deemed to have ceased to be a tax resident from the day such person left South Africa.

An individual who has become a tax resident of another country through the application of a double tax agreement will also cease to be a resident for tax purposes in South Africa.

Companies

A company is deemed to be South African tax resident either if it was incorporated here or if its place of effective management is located locally.

A company’s place of effective management may no longer be located in South Africa, for example, when the majority of a company’s board of directors move offshore on a permanent basis.

If a company becomes a tax resident of a jurisdiction with which South Africa has a double tax agreement, the company would normally cease to be South Africa tax resident.

Beware the unintended consequences

The intended outcome of informing SARS of breaking tax residency is that the taxpayer is no longer taxed in South Africa on worldwide income, but only on South African sourced income.

It may also have unintended outcomes. Informing SARS via any channel will trigger a case number as well as a request for various documents and substantiations, which taxpayers are obliged by law to provide.

If the declaration is made via the RAV01 form on eFiling, the completed declaration form must be submitted with the relevant supporting documentation. If the declaration is made on the income tax return (ITR12), the supporting documents and information requested will depend on the basis on which you have ceased to be a tax resident.

In many instances, advising SARS that you or your company intend to cease to be a tax resident will trigger an audit.

Potential tax liability

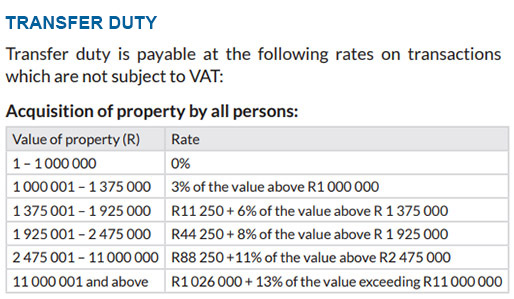

For individuals, ceasing to be a tax resident triggers a deemed disposal of worldwide assets, and exposes the taxpayer to possible capital gains tax.

Depending on the type of assets held and where they are located at the time when an individual breaks tax residence, a deemed disposal for capital gains tax purposes will take place when the person’s local tax residency ceased. The individual will be deemed to have disposed of worldwide assets at market value to a South African tax resident, with some exceptions such as certain personal-use assets and immovable property situated in South Africa.

Where a company ceases to be a South African tax resident, a capital gains tax may be triggered, and an additional dividends tax may also arise, among other possible unintended consequences.

Given the complexity of the provisions and potential tax liability, it is recommended that taxpayers rely on professional advice covering not only their South African tax position, but also their tax position in their new country of residence, well before approaching SARS.