Tax Filing Season 2021 Opened 1 July: Start Preparing!

“The secret to getting ahead is getting started.” (Mark Twain)

To avoid the last-minute rush, the risk of errors and omissions, and the cost of late submissions, penalties and audits, there is no better time to get ahead on your company and individual tax returns than the day the 2021 tax season opens.

What applies to your business – and to you?

The tax season for filing the 2020/2021 returns for both your individual tax and your company’s tax has now opened.

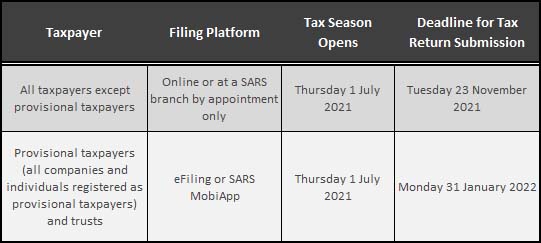

Have a look at the table below for details –

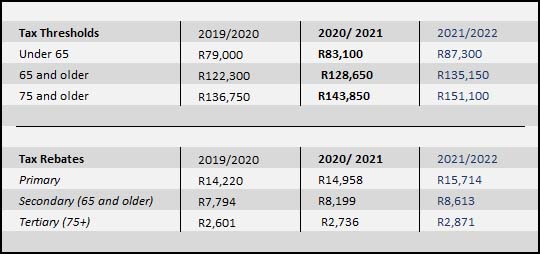

There were no changes to the corporate income tax (CIT) at 28%, or to the rate of tax on trusts at 45%. The Small Business Corporations (SBC) tax rate also remains unchanged, although the threshold is up to R83,100 from R79,000 last year (it increases for the 2021/2022 tax year to R87,300).

Personal tax rates still start at 18% for those earning up to R205,900 pa (up from R195,850 in the 2019/2020 tax year) and up to 45% on income exceeding R1,577,300 (up from R1,500,000 in the 2019/2020 tax year).

The changes to the tax thresholds and rebates for individuals are summarised in the table below –

Capital Gains tax and its specific exclusions also remain unchanged from last year, ranging from 18% for individuals and special trusts, 22.4% for companies and 36% for other trusts.

Given these tax rates, it is imperative to ensure you and your business is taking advantage of every tax deduction possible!

Take advantage of familiar and new deductions

The basic tax deductions for businesses and individuals are tax-deductible expenses, defined as any expense incurred in the carrying on of any trade, including employment income. However, there are many terms and conditions dictating when and how these deductions may be claimed, which makes it imperative to take professional tax advice.

For example, for the 2021 tax year with its numerous Covid-19 lockdowns, certain expenditure incurred while working from home can be included in the deductions. The expenses are calculated as a pro rata amount of home expenses such as rates and taxes, electricity, repairs and insurance. However, these expenses can’t be of a capital nature and no deduction can be claimed for any equipment provided by an employer without charge, or for anything that is reimbursed. Also bear in mind that claiming a tax deduction for home office use can impact on capital gains tax when you sell your home.

Red flags: what has changed since last tax season?

- Building on last year’s first auto-assessments, SARS says that – starting in July – significantly more individual taxpayers will be auto-assessed this year. If you are selected to be auto-assessed, SARS will send you an SMS. Before you accept an auto-assessment, be sure to check with your accountant that all the relevant information and declarations have been correctly included, ranging from subsistence and travelling allowances and advances to fringe benefits; and that deductions for retirement fund contributions, medical and disability expenses and even donations have been correctly applied.

- SARS has significantly improved its abilities to draw taxpayer information from third parties, including employers, financial institutions, medical schemes, retirement annuity fund administrators and other third-party data providers, making it easier than ever before for SARS to detect incorrect or undisclosed information.

- SARS has notified certain taxpayers that they are under specific scrutiny, notably ‘wealthy’ taxpayers and those with ‘complicated’ tax structures, as well as taxpayers who hold offshore assets such as crypto currencies and those who receive rental income, including from Airbnb rentals. With regard to companies, SARS states: “CIT filing compliance is currently an issue for SARS and as SARS closes in on non-compliance by companies it urges companies to note that it is compulsory for registered companies that are required to file a return to do so on time and complete in all respects”.

- The consequences of not submitting your tax return correctly by the SARS deadline are extensive.

- SARS will levy a non-compliance penalty for each month that an individual’s return is outstanding. This can range from R250 up to R16,000 a month for each month that the non-compliance continues, up to a maximum of 35 months.

- Failure to submit the return(s) for a company within the prescribed period will result in administrative penalties being imposed on a monthly basis per outstanding return and could result in a summons and/or criminal prosecution, which upon conviction is subject to a fine or to imprisonment for a period of up to two years.

- While previously a mistake made by a taxpayer was only a crime when it was done “wilfully and without just cause”, things have changed. Now, there are two categories of offence. One requires wilfulness, but the other doesn’t. In that second category, even if non-compliance was due to negligence or ignorance, taxpayers can be convicted of an imprisonable criminal offence for, among others; failure to submit a return when required to do so, to retain all relevant substantiating records; to provide any information requested by SARS; or failure to disclose any material information to SARS.

What to do now

- Don’t delay! The deadline dates are deceptively distant. However, the 23rd of November is less than 5 months away, and 31 January is just a few short weeks later. Immediately starting to prepare to lodge your tax returns will ensure that there is time to attend to any potential problems, such as finding documents, obtaining third party information or getting professional advice.

- Ensure that all sources of income are included and that all rebates and amounts allowed to be deducted or set off are also factored in, including provisional payments already made and any claims for COVID-19 tax relief.

- Keep accurate records of all the calculations and source documents used as SARS may ask for these documents to be verified and/or for the calculations to be justified.

- Get professional assistance!

Your Tax Deadlines for July 2021

|

4 Ways to Measure Your Company’s Performance, Beyond Profit

“Even if you are on the right track, you’ll get run over if you just sit there” (Will Rogers)

In the hostile business environment in which we find ourselves, every small advantage could be the difference between success and failure. While traditionally companies and their shareholders have looked at profit and the cold hard numbers for determining the current and future success of a business, there are many other non-financial measures, which can give as clear a picture as to just how strong a company is. These non-financial measures can provide clarity and context for the financial KPIs (key performance indicators), while at the same time offering a way to see whether your business is living up to its mission statement and vision in a way that the numbers cannot.

If looked at carefully these measures can help illuminate your business’ strengths and weaknesses, while also pointing to areas which may be affecting business performance.

Here then are four significant non-financial performance measures every business owner should be analysing.

- Efficiency and Delivery

The profit margin may look good, but what it cannot do is tell you just how hard you are working for that profit, or where things can be improved. How you choose to examine your company’s efficiency and delivery will depend strongly on exactly what service you are offering. For those in manufacturing an excellent statistic to look at is the “Product Defect Percentage”, which can be worked out by dividing The Number of Defective Units in a Given Period by The Total Number of Units Produced in the Same Period. This combined with a general Efficiency measure, which in the manufacturing industry can be measured by analysing how many units are produced every hour and the plant’s uptime percentage, can give you a very clear idea of inefficiencies in the system.Deadline-driven companies and those in the transport or logistics industries may want to look more closely at their “On-time Rate”, being the percentage of time products were delivered on time as scheduled. Dividing the Number of On-Time Units in a Given Period by The Total Number of Units Shipped in a Given Period will give you your “On-Time Rate”.

Customer support tickets are also a wealth of information. How many new tickets are opened, how quickly they are closed and how many go unanswered are all valuable when calculating customer satisfaction as well as flaws in your processes.

- Customer retention and conversion rates

Your customer is obviously the backbone of your business. Keeping them happy will result in success, and likewise their dissatisfaction can result in bankruptcy. Tracking the pure numbers of clients that you have, and their loyalty will give you a good indication for the coming year. Did you gain new clients, and did your old ones stay with you? Answering no to either of these questions highlights problems. If you are getting in lots of new clients, but not managing to keep them then you need to look at costs, quality and service levels, because your PR and marketing are clearly working. Alternatively if you have a core of very loyal customers, but are struggling to find new work, then what is needed is additional budget on getting your name out there.Using the formula, Customers Lost in a Given Period divided by the Number of Customers at the Start of a Period, will give you your Customer Retention Rate.

Further to this is just how successful your team is at closing a sale once that customer is through your door. Are you making sales, or winning pitches? Just how regularly? The formula for working out your conversion rate is: Interactions with Completed Transactions divided by Total Sales Interactions. If this is going up then your sales team is working optimally, but a declining conversion rate may hint at the need for morale boosts within the sales team, or even additional training.

- The power of promotion

Every business owner will know that the word of mouth and customer recommendations are the single best way to increase business and yet very few entrepreneurs or new businesses will track this statistic. It requires a little work but setting up a “net promoter score” survey is a good way to gain feedback from your customers or clients.There are principally two kinds of net promoter score surveys, ones that focus on a customer’s loyalty to the brand, known as a “relationship survey” and ones that want to analyse a customer’s experience at a specific event known as a “transactional survey”. While the latter will allow you to drill down into the details of each customer contact point, it is the former which will give you a stronger overall impression of the reputation of your brand.

This survey should be a maximum of 4 or 5 questions to avoid fatigue and increase responses. These questions should all focus on whether people enjoy interacting with the brand, where their problems may be, and a final question can ask how likely they are to recommend the company with a score out of 10.

The likelihood that customers will recommend a brand to others can be worked out by assigning people who score the company a nine and higher as promoters and those who score it six or lower as detractors. Then take the Number of Promoters and minus the Number of Detractors to find your Net Promoter Score.

Don’t forget to leave a comment box at the bottom of your survey and ask whether the customer wants to be contacted. People may have additional insights that your survey doesn’t cover.

- Maximising your workforce

Staying ahead in business depends on your employees and getting the most out of each person’s skills will greatly benefit your bottom line. Retaining good staff is an important part of the business as in the long term having experienced and knowledgeable employees will make everything else work more smoothly at the company.High performers need to be identified and retained. A good business owner is always aware of the company’s “High Performer Turn Over Rate”. This statistic reveals the company’s ability to firstly attract, but also more importantly retain, good employees. Your High Performer Turnover Rate can be calculated by dividing the Number of High Performers Who Departed in Past Year by The Number of High Performers Identified.

If you find your company is leaking high performers and the turnover rate is higher than you would like, it would be wise to work out just why this is happening. Your company’s “Salary Competitiveness Ratio” will give you an idea of whether people are leaving for money. You work it out, by taking your Average Company Salary and dividing it by the Average Salary Offered by Competitors.

If it’s not your salary offering, then perhaps chances for advancement have been stifled? High performers tend to be ambitious. Looking at the “Internal Promotion Rate” gives a great indication of whether staff are being allowed to grow and develop at a reasonable rate. It can be calculated by dividing the Number of Promoted Individuals by the Total Number of Employees.No matter what you do, people will leave, so getting high performers into the company is always important. Looking carefully at the efficiency of your hiring process with regard to time and cost to recruit new employees, will also show whether your HR systems could use an improvement. Remember, every month a position is vacant means your company is running sub-optimally and losing out on profit.