Planning to Cease Being a South African Tax Resident? What You Should Know Before Approaching SARS

“Dear IRS, I am writing to you to cancel my subscription. Please remove my name from your mailing list.” (Snoopy)

According to some estimates, as many as 1,900 millionaires have left South Africa over the last few years. A New World Wealth Africa report indicates that 4,200 high net-worth individuals left the country over the last 10 years.

Whether due to choice or circumstances, a taxpayer ceasing to be a tax resident of South Africa must declare the change to SARS.

As the number of wealthy and skilled South Africans who are emigrating increases, SARS recently announced that another channel has been made available to taxpayers to inform SARS as above.

You can now also inform SARS through the Registration, Amendments and Verification Form (RAV01) available on eFiling or at a SARS branch, by capturing the date on which you ceased to be a tax resident.

Alternatively, you can inform SARS by capturing the date on the ITR12 tax return, as before.

Informing SARS via any channel could trigger unintended consequences. In addition, to qualify the taxpayer will have to substantiate how the qualifying criteria are met.

Many intricacies

It is not as simple as filling in a form. Numerous factors are taken into account to determine whether a taxpayer has ceased to be a tax resident of South Africa.

There are three bases for qualification for individuals:

- Cease to be ordinarily resident

- Cease by way of the physical presence test

- Cease due to application of a Double Tax Agreement (DTA).

Whether an individual ceases to be a tax resident in South Africa is based on the manner in which such individual has been a tax resident. If the taxpayer has been ordinarily tax resident, the intention to cease will be supported by various objective factors. If a person has ceased to be ordinarily tax resident, it will be from the day such person ceased residence.

An individual, who is resident by virtue of the physical presence test, ceases to be a tax resident when that person has been physically outside the Republic for a continuous period of at least 330 full days. The individual will be deemed to have ceased to be a tax resident from the day such person left South Africa.

An individual who has become a tax resident of another country through the application of a double tax agreement will also cease to be a resident for tax purposes in South Africa.

Companies

A company is deemed to be South African tax resident either if it was incorporated here or if its place of effective management is located locally.

A company’s place of effective management may no longer be located in South Africa, for example, when the majority of a company’s board of directors move offshore on a permanent basis.

If a company becomes a tax resident of a jurisdiction with which South Africa has a double tax agreement, the company would normally cease to be South Africa tax resident.

Beware the unintended consequences

The intended outcome of informing SARS of breaking tax residency is that the taxpayer is no longer taxed in South Africa on worldwide income, but only on South African sourced income.

It may also have unintended outcomes. Informing SARS via any channel will trigger a case number as well as a request for various documents and substantiations, which taxpayers are obliged by law to provide.

If the declaration is made via the RAV01 form on eFiling, the completed declaration form must be submitted with the relevant supporting documentation. If the declaration is made on the income tax return (ITR12), the supporting documents and information requested will depend on the basis on which you have ceased to be a tax resident.

In many instances, advising SARS that you or your company intend to cease to be a tax resident will trigger an audit.

Potential tax liability

For individuals, ceasing to be a tax resident triggers a deemed disposal of worldwide assets, and exposes the taxpayer to possible capital gains tax.

Depending on the type of assets held and where they are located at the time when an individual breaks tax residence, a deemed disposal for capital gains tax purposes will take place when the person’s local tax residency ceased. The individual will be deemed to have disposed of worldwide assets at market value to a South African tax resident, with some exceptions such as certain personal-use assets and immovable property situated in South Africa.

Where a company ceases to be a South African tax resident, a capital gains tax may be triggered, and an additional dividends tax may also arise, among other possible unintended consequences.

Given the complexity of the provisions and potential tax liability, it is recommended that taxpayers rely on professional advice covering not only their South African tax position, but also their tax position in their new country of residence, well before approaching SARS.

What The New Employment Tax Incentive Limits Mean for Your Business

“Since the unemployment rate in the Republic is of concern to Government; and since Government recognises the need to share the costs of expanding job opportunities with the private sector…” (Preamble to the Employment Tax Incentive Act 26 of 2013 [ETI Act])

ETI fast facts

- An incentive encouraging employers to hire young work seekers aged between 18 and 29 years.

- Reduces the employer’s cost of hiring young people through a cost-sharing mechanism with government.

- Can be claimed for a 24 month period for all employees who qualify.

- Came into effect on 1 January 2014 and will end on 28 February 2029.

- ETI is claimed by reducing the amount of Pay-As-You-Earn (PAYE) due by the company, leaving the wage received by the employee unaffected.

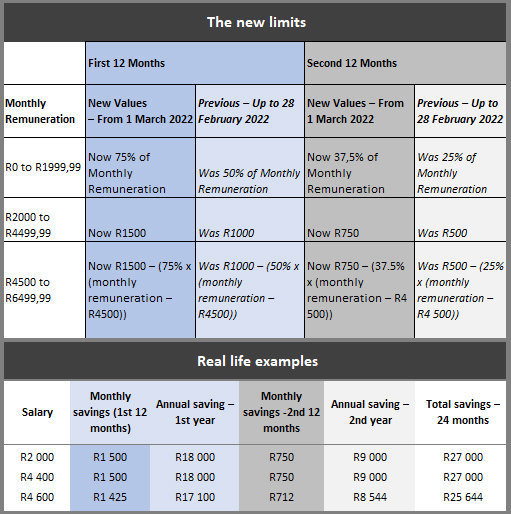

As the monthly remuneration increases, the amount of the rebate reduces: at the upper limit with a monthly remuneration of R6 400, the monthly rebate is R750.

Even so, especially for companies with many employees, these rebates will add up on a monthly basis, and stack up over two years. There is no limit to the number of qualifying employees that you can hire.

Pitfalls to be aware of

- Beware the qualifying criteria

- Employers must meet the qualifying criteria on an ongoing basis, including being registered for Employees’ Tax (PAYE) and being tax compliant.

- Employees must meet the qualifying criteria on an ongoing basis, including having a valid South African ID or permit; be between 18 and 29 years old; earning between minimum wage or R2 000 and R6 500 for a 160-hour month; and who is not a domestic worker or a “connected person” to the employer.

- Beware the continuous changes

- The value of the ETI is not static but depends on the value of the monthly remuneration paid to the qualifying employee, and must be calculated each month for each qualifying employee. In addition, if a qualifying employee worked less than 160 hours in the month, the value of the ETI must be calculated proportionally.

- The ETI is constantly being refined, expanded and tightened – including a series of amendments to the ETI Act with effect from 1 March 2022, so employers claiming ETI must stay updated to ensure they remain within the bounds of the ETI Act.

- Beware the deadlines

- If all the allowable ETI wasn’t used at the end of each six-month reconciliation period (1 March – 31 August and 1 September – 28 February), employers may be refunded the amount, if they are fully tax compliant.

- A non-compliant employer will have until the end of the next reconciliation cycle to correct any non-compliance and be able to receive the ETI refund. If the employer doesn’t become compliant by the end of the next six-month reconciliation period, the ETI refund will be forfeited.

- Beware the possible penalties

- Penalties equal to 100% of the ETI claimed will apply when an employer claims the ETI for any employee who does not qualify.

- Penalties imposed will result in under-payment of employees’ tax, which could result in possible interest and penalties in terms of the Tax Administration Act.

- A penalty of R30 000 will be levied for each employee displaced to employ an employee who qualifies.

- It has been proposed that the ETI Act be amended to impose understatement penalties on reimbursements that are improperly claimed.

- Beware the potential of audits

- A number of taxpayers have faced time-consuming and costly verifications and audits of their ETI claims.

- Additional assessments issued by SARS may reverse the ETI initially claimed by employers.

- Recordkeeping is required by the ETI Act.

- Beware of potential scams

- Employers should exercise vigilance regarding tax abusive ETI schemes and scams offered by third parties, as the employer would carry all the risk in respect of the tax and labour obligations.

Seek professional assistance to ensure you can navigate all these potential pitfalls and claim this ETI incentive, so you can employ more young people while sharing the cost with government.

A Guide to Accessing Funds That Can Help Your Small Business

“All company bosses want a policy on corporate social responsibility. The positive effect is hard to quantify, but the negative consequences of a disaster are enormous” (English economist and academic, Noreena Hertz)

Stimulating the SME sector is considered as one of the quicker ways to rejuvenating the economy. According to a 2020 survey by McKinsey & Company, SMEs make up over 98% of South African businesses, and employ between 50% and 60% of the workforce.

However, it takes money to run a business and there is a need for assisting and guiding SME owners to secure more funding, particularly given the devastating impact of the Covid-19 pandemic over the past two years.

There are varying reasons why these small businesses need additional capital, determined by differing requirements in the business value chain – including the scope of production, workforce and the nature of the business, among other factors.

Some – but not all – of the funds available in the market are allocated according to specific trades, departments in the production process and demographics of the directorship – usually according to age, race, location and gender.

Here are some examples of the grants and funds available, along with a brief overview of the funding models

- Equipment related financial support. The Department of Trade and Industry’s (DTI) Small Enterprise Development Agency (SEDA) Technology Program, provides both “financial and non-financial technology support” – meaning either funds or equipment support for small enterprises.

-

- Staff training. The DTI’s Black Business Supplier Development Program offers grants in a cost-sharing scheme to black-owned businesses for the purpose of business skills training.

-

- Female directors can take advantage of gender-empowerment funding programs like the Business Partners Women in Business Fund, which is aimed at increasing access to finance for female entrepreneurs for them to start, expand or purchase existing businesses.

-

- A more narrowed down version of this model of funding is the I’M IN Accelerator Fund, which is for black South African women who have founded technology start-ups. They can apply to be part of this 10-month long acceleration program and possibly access up to R1,5 million in pre-seed capital, mentorship, marketing support and follow-on investment. The business has to be 51% black- and-women owned to qualify.

-

- The National Empowerment Fund (NEF) is a black economic empowered driver and funds businesses with a black majority ownership.

-

- The DTI funding model is usually segmented according to factors like industry, marketing channels and/or the age of the directorship. However, qualifying small businesses can currently obtain the following loans and grants:

- The Umsobomvu Youth Fund: A Government initiative aimed at creating opportunities for South African youth in entrepreneurship and job creation, helping youth setup, expand and develop their businesses by teaching them essential business skills. Umsobomvu is a Voucher Program not a loan program. The Voucher Program provides support services to both new and existing youth owned businesses.

- The Agro-Processing Support Scheme (APSS) is a R1-billion cost-sharing grant fund aimed at boosting SME investments in the agricultural space. Minimum qualifying investment size, including competitiveness improvement cost, will be at least R1 million.

- The Aquaculture Development and Enhancement Program (ADEP) is a cost-sharing incentive program for projects in primary, secondary and ancillary aquaculture (activities in both marine and freshwater).

- The Support Program for Industrial Innovation (SPII) is aimed at funding the innovation and development of technological products in South Africa.

- R&D Tax Incentive is supported by the Treasury and offers a deduction of 150 percent in respect of expenditure on eligible scientific or technological Research and Development (R&D) undertaken by companies in South Africa. In his 2022 Budget Speech, the Minister of Finance announced that the R&D Incentive is under review but that it will be extended in its current form until 31 December 2023

. - The De Beers Fund: At a more localised level, a large diamond mining company also awards grants, for small businesses located in its operating areas. These areas are Kimberley and surrounding areas in the Northern Cape, Viljoenskroon and surrounding areas in the Free State, Musina, as well as the Blouberg Local Municipalities in Limpopo.

- Tshikululu Social Investments: Tshikululu is South Africa’s leading social investment fund manager and advisor, working alongside investors and other development partners to achieve sustainable social impact. The organisation manages other companies’ CSI funds.

Over the years, the organisation has managed the likes of the De Beers Fund, Rand Merchant Bank Fund, among others.

- SA SME Fund: Established by members of the CEO Initiative as a collaboration between government, labour and business to address some of the most pressing challenges to the country’s economic growth – as an avenue of support for the SME sector. The SA SME Fund invests in repayable funds that support and develop entrepreneurs, typically with an enterprise value of less than a R100m.

- Financiers: These are licensed lenders with their own products and terms of trading, being that they are private entities. However, the terms have to be agreeable with trade regulations, including Fair Practice – which protects the borrower’s interests.

If you need an urgent loan, private financiers might be an alternative to the grants and cost-sharing schemes mentioned above. There are several types of loans that small business owners can apply for, depending on the individual needs of their businesses. The following are the repayable financing products available to SMEs:

- Purchase order finance is used by a business to complete an existing order.

- Working capital finance is an option that can boost a small business with much needed cash flow.

- Bridging finance is a short-term loan that can be used by small businesses to finance their working capital. An example of this is Lula-lend, which positions itself as a good option if your business requires a loan provider and you need urgent funds of between R10 000 and R5 000 000. The company can have the funds in your account within days and repayment is over 3-12 months.

- Credit cards can be handy for entrepreneurs; however, they require discipline as their interest charges and repayment rates are normally higher.

- Inventory loans can help your small business keep enough stock in the inventory. It is more suitable for small businesses with tangible products to sell.

Because of the varying types of funds, SME owners are encouraged to consult with financial advisers in order to make the right decisions for their individual businesses’ needs, the amount required and the right funding model.

Don’t miss out, ask for professional advice about grants and take advantage of the opportunities they afford small businesses.