The Simple Solution to Hassle-Free EMP501 Final Recons

“The employer in collaborating with SARS plays a critical coalition towards adherence and compliance of tax principles and laws.” (SARS External Guide – A Guide to The Employer Reconciliation Process)

By law, employers must deduct or withhold employees’ tax from remuneration and pay this to SARS monthly on or before the 7th of the following month with the EMP201 declarations; and must also reconcile employees’ tax during the interim reconciliation (due end October) and the annual reconciliation (due end May) when tax certificates (IRP5s/IT3(a)s) must also be issued to employees.

What the EMP501 achieves

The Employer Reconciliation Declaration (EMP501) is effectively a summary of all the monthly Employer Declarations (EMP201s) for the filing period or tax year, and as with the EMP201, also contains information regarding the ETI (Employment Tax Incentive), where applicable.

The EMP501 matches the payroll information regarding the employees’ tax deducted or withheld from remuneration – the PAYE, UIF and SDL (Skills Development Levy) liability – as well as ETI, with the payments made to SARS and the information on the employees’ tax certificates.

As such an EMP501 reconciliation requires:

- the monthly EMP201 employer declarations for the period detailing the payroll taxes liabilities (PAYE, SDL, UIF), as well as ETI

- all employees’ updated details and correct values on their (IRP5s/IT3(a)) tax certificates

- actual payroll tax payments made to SARS.

The values on the EMP201 declarations and the tax certificates should balance with actual payments made to SARS.

An accurate and correct EMP501 reconciliation is important because SARS uses the IRP5/IT3(a) certificate information submitted by employers through the annual reconciliation process to prepopulate the employees’ annual income tax returns (ITR12). Employees cannot change this information, so any incorrect information will influence the employee’s personal tax assessment.

The reconciliation process also allows employers to review the monthly EMP201 declarations and if any discrepancies are identified, these must be corrected before submitting the EMP501.

Furthermore, ETI refunds (unused ETI amounts) can only be claimed by submitting interim and annual reconciliations (EMP501s). Failure to do so will result in an ETI refund being forfeited.

The solution to a hassle-free EMP501 submission

In theory, if all the employees’ details are correct and updated, and each EMP201 for the period was correctly completed, submitted and paid, the EMP501 reconciliation should be quite simple.

In reality, it seldom is.

Here are a few of the most common examples where the recalculated (actual) monthly liabilities could differ from the original liability amount declared on the EMP201s:

- A delay in implementing the correct tax tables resulting in an over/under-deduction of tax.

- Any administrative timing difference in updating your payroll records with updated employee information.

- Differences arising due to fluctuations in monthly remuneration.

- An over/under-deduction where, for example, an employer spreads an employee’s 13th cheque tax over a year and the employee resigns before the bonus is due.

Any differences must be reconciled and corrected before the EMP501 can be submitted.

In addition, verified and updated employer and employee information is required to successfully submit the EMP501 reconciliation.

This all adds up to a potentially time-consuming and frustrating process. Of course, the simple solution is to ensure that at all times, the employer and employee information is updated and correct, and that each month, the correct EMP201 declarations and payments are made and that any discrepancies are corrected promptly.

Given the complex nature of employee taxes, a recognised payroll system with automatic updates when tax and other changes are made, is a crucial tool to achieve updated and correct payrolls month after month, and as a result, hassle-free EMP501 reconciliations.

Running out of time?

With the next deadline for this year’s final EMP501 reconciliation around the corner, some companies may realise that they are running out of time.

Before the end of May, all employees’ information must be verified and updated – including valid ID/passport numbers, employee income tax numbers, residential and postal addresses, payment methods and bank account details, and employee classifications. It is not possible to submit the EMP501 reconciliation unless all the mandatory fields for each employee are correctly completed.

The employees’ tax certificates must also reflect all the income, deductions, benefits and contributions pertaining to each employee for the period, recorded under the relevant codes.

Keep in mind that this information is legally required, and you may be subject to penalties for missing information.

If there are any errors, the certificates must be rectified and the EMP501 reconciliation resubmitted. This is costly in time and resources and may result in penalties.

Offences and penalties

An employer who, ‘wilfully or negligently’, amongst others fails to submit monthly declarations; interim and annual reconciliations and/or the annual IRP5/IT3(a)’s is guilty of an offence and is liable, upon conviction, to either imprisonment for up to two years or both imprisonment and a fine.

Non-compliance also includes wilful or negligent failure to deliver an IRP5 to an employee or former employee, deducting or withholding employees’ tax from employees without paying it to SARS, or failure to keep the correct employee certificates, EMP201 and relevant documentation for audit purposes.

The final reconciliation and submission of employee tax certificates to SARS must take place by the end of May. Not doing so will result in a PAYE admin penalty being imposed on the EMP501 return reconciliation for non-compliance. The penalties are levied in 1% increments over a period of 10 months and are based on the employer’s liability for that year of assessment (12 month period). Depending on the number of months outstanding, the penalty is up to 10% of the total employees’ tax liability.

Given all these obligations to be met, as well as the penalties that may apply, companies are well-advised to seek assistance from a professional with the necessary knowledge, experience and resources to assist in completing the process in the few short weeks ahead, as well as to ensure hassle-free EMP501 recons in future.

Companies: How Will the Reduced Tax Rate and Assessed Loss Rules Affect You?

“What the government gives it must first take away.” (John S. Coleman)

It certainly seemed like a win for taxpayers when Finance Minister Enoch Godongwana announced in his February Budget Speech that the corporate income tax (CIT) rate has been reduced from 28% to 27% for companies with a tax year ending on or after 31 March 2023.

But as we are reminded by John Coleman’s quote: “What the government gives it must first take away.”

In this particular instance, to give a 1% reduction in the corporate tax rate, government limited the tax relief corporate taxpayers have enjoyed in the past in terms of assessed losses and interest deductions.

According to Treasury, South Africa is following an international trend evident over the past few years to restrict the use of assessed losses and reduce the corporate income tax rate.

What’s the link to the corporate tax rate reduction?

The 1% reduction in the corporate tax rate is expected to cost the fiscus R2.6 billion -in the year of assessment commencing on or after 1 April 2022. To ‘neutralise’ this – and thus achieve a revenue-neutral reduction in the corporate tax rate – two further changes to corporate tax rules have been made.

The first is further limitation of corporate interest deductions, specifically on multinationals; and the second is restrictions on the use of assessed losses to reduce future corporate tax liabilities.

The first involves changes to, amongst others, the scope and thresholds of the interest deduction limitation, achieved by fixing and limiting the interest deduction limitation ratio to 30% of a taxpayer’s “adjusted taxable income”, instead of the earlier flexible percentage (adjusted upwards and downwards based on the average repo rate) capped at 60%.

What are the new assessed losses rules?

Assessed loss rules were originally created to smooth the tax burden for:

- businesses that require a significant upfront capital outlay, causing assessed losses to accumulate before any profit is realised;

- cyclical businesses that realise losses in some years and profits in others, such as farming operations, and

- companies that suffer temporary setbacks and losses before recovering to become profitable again.

As a result companies could previously offset the full balance of any assessed loss carried forward from a previous tax year against all its taxable income for the current year. In addition, companies could carry over any assessed loss balance remaining to future years indefinitely subject only to the requirement that the company continues to carry on a trade. In effect, it meant that a company would only become liable for income tax once it earned a taxable profit and the balance of the assessed loss was exhausted.

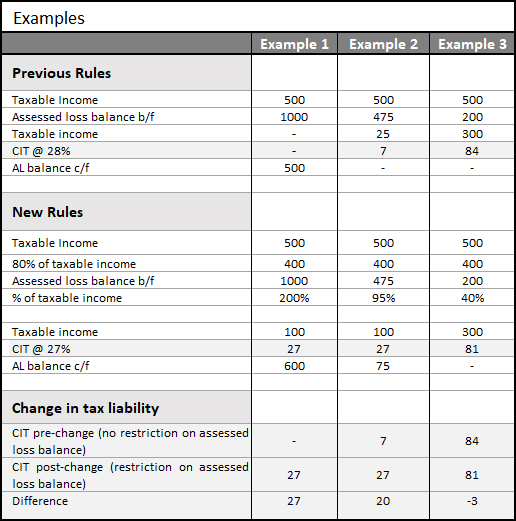

Under the new rules, assessed losses brought forward from a previous year of assessment – regardless of the amount – can only be offset against the higher of R1 million or a maximum of 80% of taxable income for the current year.

This means that income tax will now always be levied on 20% of the taxable income for the year where the taxable income in the current year exceeds the R1 million threshold, no matter what the assessed loss balance carried forward from previous years may be. This will have adverse tax cash flow implications for some companies.

Small companies unaffected, and losses are not forfeited, unless…

Smaller companies with a taxable income below R1 million will not be affected by the new rules.

Further good news is that companies will not forfeit the balance of the assessed loss that could not be utilised. The balance can be carried forward to the next tax year, provided that the company earns income from trade in the succeeding year of assessment.

However, beware: if a company does not trade for a full year of assessment and no income is earned from such trade, the assessed loss will be lost.

When do the new rules apply, and which companies are affected?

The new rules apply to any year of assessment that ends on or after 31 March 2023, which, in more practical terms, means years of assessment that begin from 1 April 2022 onwards.

It is also important to note that the new limitation will apply to assessed losses generated prior to the effective date, as well as those arising after 1 April 2022.

Some companies will not be affected immediately, for example, companies with no assessed loss balance, or those with a taxable loss.

The cash flow implications, with examples

For those companies affected, the changes will have tax cash flow implications, best illustrated by the way of examples –

Table based on an example from Draft Explanatory Memorandum On The Taxation Laws Amendment Bill, 2021

Your Tax Deadlines for April 2022

- 1 April Start of the 2022/23 Financial Year

- 7 April Monthly Pay-As-You-Earn (PAYE) submissions and payments

- 25 April Value-Added Tax (VAT) manual submissions and payments

- 28 April Excise Duty payments

- 29 April Value-Added Tax (VAT) electronic submissions and payments & CIT Provisional payments where applicable.