Loadshedding: Tax Incentives for Energy Efficiency and Alternative Power

“This is a call for all South Africans to be part of the solution; to contribute in whatever way they can to ending energy scarcity in South Africa.” (President Cyril Ramaphosa)

For more than a decade, local businesses have faced the huge challenge of an unreliable power supply from a state-owned monopoly that allowed very little in terms of affordable or practical alternatives.

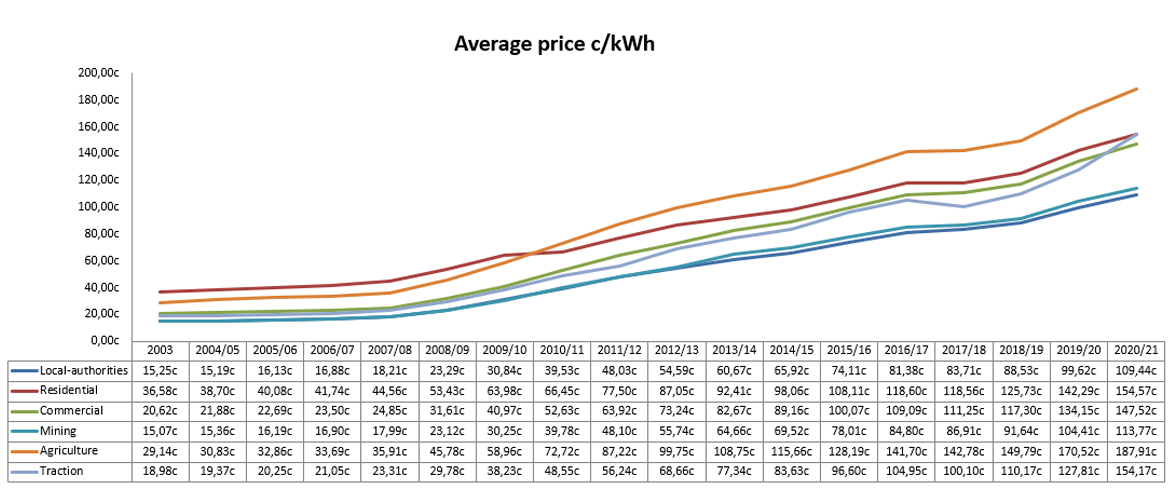

In addition, since then Eskom’s electricity prices continued to skyrocket – increasing by more than 400%.

Click here to view | Source: Eskom Distribution

Just a month ago, Eskom proposed a further tariff increase of 32.7% to the National Energy Regulator of South Africa (Nersa) and is also contesting, in court, the tariff increase of 9.6% for 2022/23 Nersa allowed, which was far below the 20.5% requested.

A national crisis

South Africa’s energy crisis has been described as the biggest risk to the country’s economy. Recently President Cyril Ramaphosa, in his address to the nation on the energy crisis, announced measures to tackle it, including scrapping the licensing threshold of 100MW, Eskom buying more electricity from existing independent power producers, importing power from Botswana and Zambia, and doubling the amount of renewable generation capacity procured through Bid Window 6.

Of particular interest to businesses and individuals are the measures designed to enable businesses and households to invest in rooftop solar.

“South Africa has great abundance of sun which we should use to generate electricity. There is significant potential for households and businesses to install rooftop solar and connect this power to the grid,” the President explained. “To incentivise greater uptake of rooftop solar, Eskom will develop rules and a pricing structure – known as a feed-in tariff – for all commercial and residential installations on its network. This means that those who can and have installed solar panels in their homes or businesses will be able to sell surplus power they don’t need to Eskom.”

This certainly provides reasons for companies to re-assess the long-term viability of alternative energy sources, particularly photovoltaic (PV) solar energy projects, which are incentivised because of their low impact on the environment and our scarce water resources.

In particular, the President called on businesses to:

- seize the opportunities that have been created and invest in generation projects

- reduce consumption through greater energy efficiency.

The good news is that there are tax incentives to assist in achieving these national priorities.

Section 12B of the Income Tax Act provides for capital expenditure deductions for assets used in the production of renewable energy and particularly incentivises the development of smaller solar PV energy projects with an accelerated capital allowance of 100% in the first year for solar PV energy of less than 1MW.

Section 12U of the Income Tax Act provides for capital allowances for roads and fencing used in the generation of electricity.

Section 12L of the Income Tax Act is aimed at directly incentivising investments in local energy efficiency projects and provides a deduction for actual savings resulting from a reduction in energy use.

Capital expenditure deductions (S.12B)

Section 12B provides for a 50%/30%/20% income tax deduction over three years for certain machinery or plant – which means 50% of the costs of the assets can be deducted in year one, 30% in year 2, and 20% in year 3. These assets must be owned by the taxpayer, brought into use for the first time by the taxpayer, for the generation of electricity from, amongst others, photovoltaic solar energy or concentrated solar energy. The tax deduction also applies to any improvements to the qualifying plant or machinery that are not repairs related.

The following types of renewable generation projects may benefit from the allowance:

- wind power;

- photovoltaic solar energy;

- concentrated solar energy;

- hydropower (producing less than 30 megawatts); and

- biomass comprising organic wastes, landfill gas or plant material.

In respect of photovoltaic solar energy of less than one megawatt, a 100% income tax deduction is allowed in the first year of use.

What this means is that the cost related to a new solar power system can be deducted as a depreciation expense– reducing the income tax liability. The reduction can be carried over to the next financial year as a deferred tax asset.

In a previous binding ruling, SARS confirmed it will allow for both the capital cost of solar power units, as well as the direct cost of installation or the erection thereof.

The capital costs that may be deducted are:

- Photovoltaic solar panels;

- AC inverters;

- DC combiner boxes;

- Racking; and

- Cables and wiring.

In addition, related allowable costs of installation are:

- Installation planning expenses;

- Panels delivery costs;

- Installation expenses; and

- Installation safety officer costs.

Taxpayers installing assets used in the production of renewable energy, and particularly smaller solar PV energy projects or systems should investigate the tax benefits of Section 12B, particularly now that selling electricity back to Eskom will soon be a reality.

Capital allowances for roads and fencing (S.12U)

Section 12U provides for capital allowances for roads and fencing used in the generation of electricity greater than 5MW from wind; solar; biomass comprising organic wastes, landfill gas or plant material; and hydropower to produce more than 30MW. It is granted in full in the year of expenditure and covers improvements to the roads and fencing related to the generation project, as well as foundations or supporting structures.

Energy-efficiency incentive (S.12L)

Section 12L, read with the Regulations, allows any person or entity registered with the South African National Energy Development Institute (SANEDI) to claim a deduction for energy-efficiency savings derived from activities performed in the carrying on of any trade.

The incentive allows for a tax deduction for all energy carriers (not just electricity, but also fuel) but with the exception of renewable energy sources.

Ownership of energy-efficient machinery and equipment is not a requirement to claim a deduction under section 12L, so a lessee of the machinery or equipment can equally claim a deduction under section 12L.

The deduction is calculated at 95 cents per kilowatt hour or kilowatt hour equivalent of energy-efficiency savings and can create or increase an assessed loss.

A taxpayer must comply with certain requirements before being eligible for this deduction, for example, taxpayers are required to register with SANEDI, and a measurement and verification professional belonging to an accredited measurement and verification body must be appointed. An energy-efficiency performance certificate must be obtained from SANEDI detailing the energy-efficiency savings generated for the year of assessment.

Examples of energy-saving measures include, for example, investing in more efficient technologies such as LED lighting; installing clear acrylic door refrigeration equipment to reduce energy consumption in retail stores; using recycled waste heat from refrigeration plants or furnaces to reduce another electrical heating load; or investing in energy saving solutions for HVAC and refrigeration.

With this incentive, businesses can ensure their energy efficiency measures not only result in lower energy costs but also reduces their tax liability.

When heeding the President’s call to invest in generation projects and reduce consumption through greater energy efficiency, businesses and individuals are well advised to investigate further the tax incentives and rebates available. These are complex, so seek professional advice!

Your Tax Deadlines for August 2022

- 5 August – Monthly Pay-As-You-Earn (PAYE) submissions and payments

- 25 August – Value-Added Tax (VAT) manual submissions and payments

- 30 August – Excise Duty payments

- 31 August – Value-Added Tax (VAT) electronic submissions and payments & CIT Provisional payments where applicable.

Choosing Accounting Software for Your Small Business

“Creativity is great – but not in accounting.” (Charles Scott, Former governor of Kentucky)

Being able to track money as it is coming in and going out is essential for small business owners. Not having proper cash flow management and a full understanding of where your money is going makes it hard to analyse where your business can improve and whether it is succeeding. Come tax season compiling your tax returns accurately becomes extremely difficult if you haven’t been keeping track of every receipt and invoice.

Fortunately, small business owners can now use out-of-the-box software that is capable of helping them to track these important aspects and ultimately to compile their various tax returns. This software can also help when it comes to invoicing clients, reconciling transactions and generating the reports. But how do you know which software programs are right for your business and which are simply more powerful than you need? And how do you balance the features you want with the budget you have?

Ask yourself these six questions –

- Is it simple to use?Perhaps this goes without saying, but any software you choose needs to be simple to use. As a new business owner you are likely not an accountant and perhaps you lack basic IT skills (which is not unusual). The more complex the system the more time it will therefore take for you to get used to it, and further, to actually complete the day’s necessary tasks. When you are already overloaded with work, the addition of an extra thirty minutes of bookkeeping a day can really add up and put strain on your other deadlines.

While reviews can be helpful to narrow down your selection, it is advisable that you try out a few accounting systems before you settle on the one you want to use. Most accounting software is offered on either a free trial or comes with a guided demo to explore the interface that is easily visible before any purchase. If the software you are looking at has neither, it is wise to stay clear.

If there is more than one person who will be using the system involve everyone in the decision-making process. Draw up a list of essential, common uses and take the opportunity of the trial to run through generating monthly reports, sending invoices, and running payroll. Simply by testing the software you will quickly discover which is the better fit for you and your team.

It’s very important that the software is easy enough to use straight from the get-go. Don’t make excuses for the program by blaming yourself or promising it will be easier to use once you have “played around a bit.”

- How good is the technical support?In this light, it’s also extremely important that whatever software you do go with has helpful and responsive support. If you do ever run into a problem, it can cost a fortune to get an independent expert to help out, so rather go with a program that comes with the support you need from the beginning.

Generally, the best way for you to gauge whether their technical support is good is by looking at the reviews. Make sure you read these carefully and look for any issues around a lack of responsiveness from their side. Believe us, if there are problems, they will all be spelt out in the review. The worst time to find out that a company you are about to work with is not helpful is just after the system has collapsed and invoices are waiting to be sent out.

- What features do you need?Before you commit to buying any software it is extremely important that you work out just which features you need, which you don’t and which may be nice to have. What do you need the accounting software to do? Must it be able to track accounts receivable and payable? What kind of reports do you need to generate? Do you need it to track inventory? Do you need it to include ancillary services, such as time tracking, project management and payroll? Determining these aspects is important as every feature you add will likely also add to the cost and you don’t want to be paying for features you really don’t need.

There are other features to consider too that have little to do with the actual accounting functionality of the system. There are:

- Integration: How easily does this software integrate with your other systems. It’s no good buying an accounting program that only runs on Apple when you are a Windows Office user. Beyond the obvious you should ask, “Does this software integrate with your shipping system, and sales platform?” Choosing software that integrates across the board could save hundreds of hours of troubleshooting in the future.

- User access: Just how many people can be authorised to use this piece of accounting software? Can you set different levels of visibility and authority for different people? Perhaps you want your sales team to be able to invoice clients, but not see all the same things your accountant can see? Is this possible? Make sure the system you buy has the user access capabilities you need.

- Accessibility: How accessible is your data? Most accounting solutions these days offer cloud-based access, allowing you to check your accounts from anywhere in the world and on any device. Which services are available on the app and which are available on the core program? Which services are essential for you to be able to operate remotely?

- What is your budget?Every cent can make a difference to the small business and your accounting software is no different. When making your choice, it’s important to formulate a budget and stick to it. Apart from your starting costs watch out for any additional charges, which may add up. When purchasing make sure you fully understand things like setup and customisation fees, to make sure you’re not missing anything.

- Will you need to upgrade down the line?When choosing an accounting system, you need to be aware, not only of your needs now, but also of your potential needs in the future. You may only need essential recording and reporting at this stage, but in the future might foresee the need to scale the system to do payroll and other valuable tasks. Carefully balance your current budget and your needs with your potential growth – how long will it take before you need to upgrade? What features will you need when you do? You may decide that you need to choose a system now that can be easily scaled at a later date, requiring you to spend a bit more money. Alternatively, it may make sense to use a simple system now with no scalable benefits and then overhaul it to a more complete system later. All of this is going to depend, not only on budget but on how much appetite you have for training and learning new systems in the future.

- What do your accountants suggest?

Discuss your financial recording and reporting needs with your accountants. It is likely they have assisted and advised other clients on the selection and set-up of systems appropriate to various businesses’ needs. They may well have ‘war stories’ to tell of issues and systems you need to be wary of.