How the New Assessed Loss Tax Limitation Works

“People who complain about taxes can be divided into two classes: men and women.” (Unknown)

The assessed loss rules have always allowed companies to deduct from their taxable income each year any assessed losses from previous years. The remaining assessed loss balances could be carried forward indefinitely. This meant that a company would only pay income tax once it made a taxable profit and all previous assessed losses had been deducted from the taxable income.

These rules have changed and may affect your next income tax bill.

What’s new?

Under the new rules, assessed losses brought forward from a previous year of assessment can only be offset against a maximum of 80% of the current year’s taxable income or R1 million, whichever is higher.

This means that many companies will now pay income tax on up to 20% of the taxable income for the year if it exceeds R1 million, even if the assessed loss balance carried forward from previous years far exceeds the taxable income. Adjust your cash flow forecasts accordingly.

What you should know

- The new rules apply to any year of assessment that began on 1 April 2022 onwards and that ends on or after 31 March 2023.

- The new limitation applies to a company’s assessed loss balance as at 1 April 2022, and not only to assessed losses accumulated after this date.

- Companies do not lose the balance of an assessed loss that could not be utilised in one tax year, it is just carried forward to the next tax year.

- If a company does not trade for a full year of assessment and no income is earned from such trade, the assessed loss balance will be lost.

- Further complex rules may apply in certain circumstances, for example, the 3-out-of-5-years rule and the ring-fencing of losses if a business carries on one of the listed “suspect trades”, which means professional advice is essential when deducting an assessed loss against taxable income.

Will your tax bill be affected?

Some companies will not be affected immediately, for example:

- Companies that made a loss during the year and therefore have no taxable income to reduce;

- Companies that do not have an assessed loss balance brought forward; and

- Smaller companies with a taxable income below R1 million are not affected by the new rules and can still deduct the full balance of an assessed loss against 100% of their taxable income.

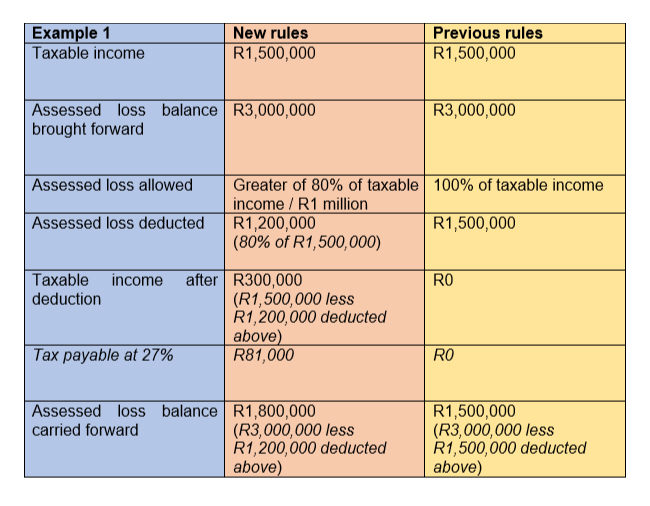

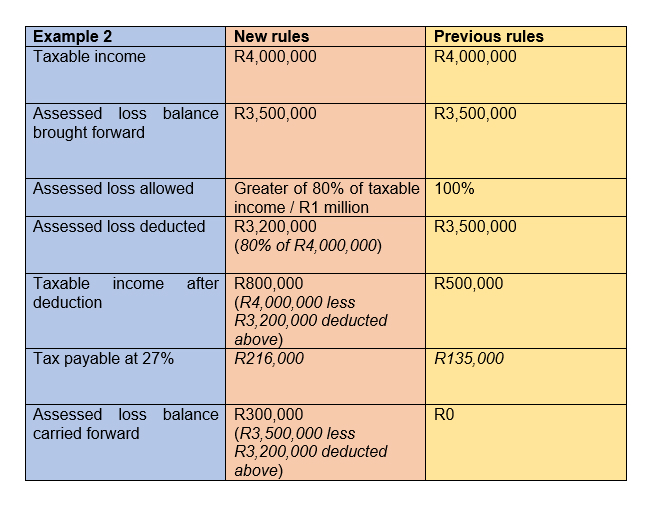

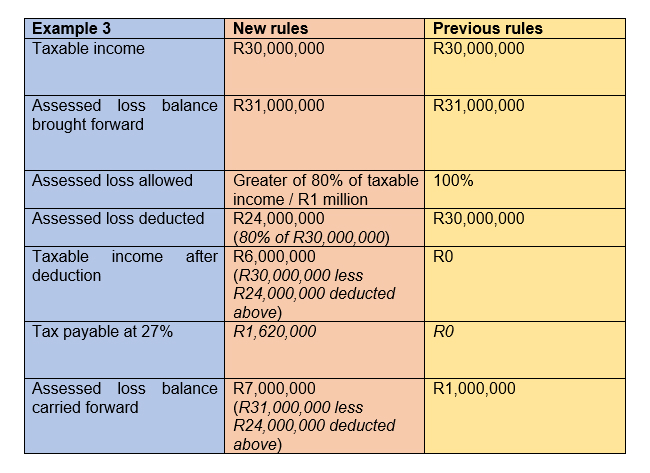

However, the changes will have tax cash flow implications for other companies. The examples below illustrate this.

|

|

|

Both the old and the new rules are complex. In addition, some of the wording in the legislation still needs to be clarified, so speak to your accountant about the impact the new rules will have on your next tax bill.

Maximise Your Business Travel Tax Deduction

“Without a logbook, you will not be able to claim a travel deduction.” (SARS Travel Logbook 2022/23)

Even while recovering from the economic impact of COVID and facing the challenges of power blackouts, businesses and their employees are also contending with the costs of travel that have reached historic highs. Thankfully, expenses related to business travel can be deducted from taxable income – reducing the tax liability for taxpayers, including businesses, employees, commission-earners and independent contractors. All these taxpayers should prioritise maximising the available tax deductions by ensuring they can claim for every actual business travel-related expense.

This is increasingly important given the rapidly rising costs of travel, fuel and vehicle ownership. Fuel prices have more than doubled over the last five years and continue to set new records. In addition, Wesbank recently reported that the monthly cost of vehicle ownership for an average entry-level vehicle is 33% higher than five years ago and has increased 32% between November 2021 and November 2022.

To claim any business travel expenses, it is compulsory to keep an accurate and up-to-date SARS-compliant logbook for each vehicle. In addition, there are other tax implications related to travel expenses, travel allowances and travel reimbursements, some of which are briefly highlighted below.

Claiming the business travel deduction – fast facts

- Businesses can claim business travel expenses incurred in the production of income.

- Employees who receive a travel allowance can claim a deduction for the use of their private vehicles for business purposes.

- Employees may also be entitled to claim a reduction on the fringe benefit in respect of business kilometres travelled in a company car.

- To claim any travel deduction, an accurate, up-to-date logbook detailing all business kilometres travelled is required. SARS accepts electronic logbooks.

- There is no deduction allowed for private travel, which is any travel not for business purposes, such as travelling between home and work.

- In addition to a logbook, taxpayers who want to claim actual travel expenses should keep accurate records and proof of all travel expenses, such as fuel and maintenance, incurred during the year.

- A separate logbook and records must be kept for each vehicle used for business purposes.

- SARS reserves the right to query and audit the content or information recorded in any logbook by the taxpayer.

- Logbooks and other records must be kept for at least five years as taxpayers may be required to submit them to SARS for verification of travel claims.

How to claim a business travel tax deduction

- Record the vehicle’s odometer reading on the first day of a tax year (1 March for individuals and also for companies).

- Maintain the logbook all year – SARS requires the following minimum information for every single business trip: date of travel; kilometres travelled; and travel details including where the trip started, the destination and the reason for the trip. It is not necessary to record details of private travel.

- Keep records of all related travel expenses such as fuel, oil, repairs and maintenance, car licence, insurance, vehicle tracking costs, wear-and-tear, and finance charges or lease costs to claim the actual travel costs incurred.

- Record your motor vehicle’s closing odometer reading on the last day of the applicable tax year (end of February for individuals and also for many companies). The difference between the opening odometer reading and the closing odometer reading equals the total kilometres (business and private) travelled for the full year.

- Calculate the total business kilometres for the year using the detailed logbook.

- The travel deduction can then be calculated in one of two ways:

- Use the cost scale table supplied and updated annually by SARS, if you have not kept an accurate record of all travel expenses – the table simply provides a rate per kilometre based on the value of the vehicle, or

- Calculate the claim based on actual costs incurred, determined by the accurate records and proof of all business travel expenses during the year, in addition to the logbook.

Tax implications to beware of

- If an employee receives a travel allowance as part of his/her remuneration, 80% of the travel allowance must be included when calculating PAYE. This percentage is reduced to 20%, where the employer is satisfied that at least 80% of the motor vehicle use during the tax year will be for business purposes.

- However, if there is any underpayment of PAYE on the travel allowance due to incomplete or incorrect information, the employer is liable for any shortfall, so obtain professional advice before providing travel allowances and ensure employees with travel allowances keep detailed logbooks.

- Fuel costs can only be claimed if the employee pays the full cost of fuel used in the vehicle, and similarly, maintenance costs can only be claimed if the employee carries the full cost of maintaining the vehicle, for example, if the vehicle is covered by a maintenance plan.

- Where a travel allowance or advance is based on the actual distance travelled by the employee for business purposes (reimbursive travel allowance), it is non-taxable (i.e. no employee’s tax must be deducted) provided that two criteria are met: the rate per kilometre is not higher than the rate published by SARS, and no other compensation in the form of an allowance or reimbursement (except parking or toll fees) is received in respect of the vehicle.

- If the two criteria mentioned above are NOT met, the reimbursive travel allowance is taxable and employees’ tax must be deducted from any amount that exceeds the prescribed rate per kilometre.

To maximise the tax deductions related to business travel, make sure that an accurate and up-to-date SARS-compliant logbook is kept current for each vehicle and each employee with a travel allowance, and that you consult with your accountant to understand the many tax implications for all concerned before making decisions regarding business travel.

Your Tax Deadlines for January 2023

- 6 January – Monthly Pay-As-You-Earn (PAYE) submissions and payments

- 30 January – Excise Duty payments

- 31 January – Value-Added Tax (VAT) electronic submissions and payments & CIT Provisional payments where applicable.