How to Achieve Tax Compliance Throughout 2024

“SARS is willing and ready to assist taxpayers who want to be compliant. Where taxpayers willfully and intentionally ignore their legal obligations, SARS will act sternly.” (SARS Commissioner Edward Kieswetter)

Businesses are often required to share their tax compliance status, for example for a tender application, bidding process or prequalification as a supplier; to confirm that their tax affairs are in order with SARS; to receive payment; or for foreign investment allowances.

This is because proof of tax compliance is accepted as an indicator of how well a company is managed and its good standing in terms of its legal obligations. Tax compliance also saves time and money.

SARS provides clear advice to owners of small, micro and medium enterprises (SMMEs) on how to achieve tax compliance, both in the business and in their personal capacity, including a recommendation to seek the advice of an accountant.

Which tax types apply to you and your business?

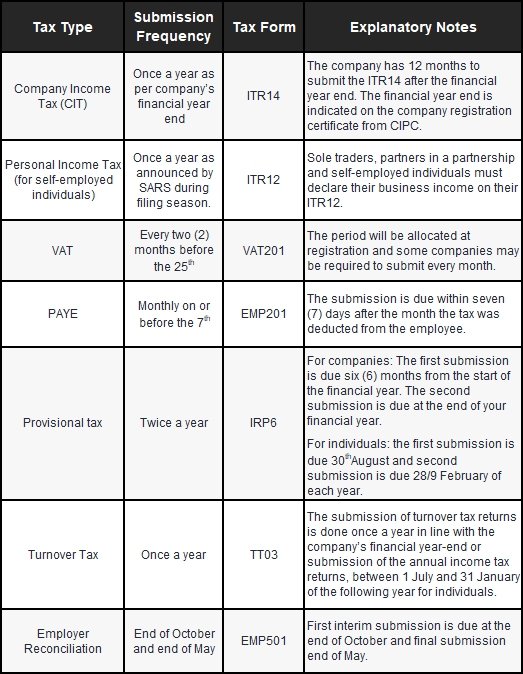

This handy table from SARS details the tax types that generally apply to SMME businesses and their owners.

Source: SARS

Compliance life cycle

The “compliance life cycle” as SARS calls it, applies to each one of the tax types for which the business and the owner are liable.

It involves completing these steps in your tax relationship with SARS from beginning to end:

- Registration on SARS’ system for each tax type applicable;

- Timely and correct declarations or returns for each tax type, including submitting relevant supporting documents;

- Timely payments where a tax liability exists; and

- Deregistration from tax types if the business is liquidated or closed.

To meet these requirements consistently across all the relevant tax types over the tax year, in an always-changing tax landscape, taxpayers should consider professional assistance.

Consequences of non-compliance

Non-compliance is a costly choice, generally involving penalties and interest, as well as additional fees to rectify, and potentially further losses, such as losing a business opportunity or the confidence of clients, stakeholders and investors, or suffering reputational damage.

In addition, not registering for a tax type to evade paying taxes, as well as the non-submission of tax returns are criminal offences, which may result in a fine, imprisonment or both.

Outstanding returns will also negatively affect tax compliance status, and administrative penalties that will attract interest may be incurred for non-submission.

Where tax liabilities have not been paid, and no payment arrangement has been made, penalties and interest will also apply, tax compliance status will be affected, and SARS may appoint third parties, such as a registered bank, to recover the outstanding tax.

Ensuring compliance

Human errors and simple mistakes are common given the complex tax types, rules and strict deadlines. Nevertheless, a taxpayer can be found guilty of an offence without SARS having to show that the taxpayer committed it wilfully, deliberately and knowingly. It means that even unintentional or administrative errors can be penalised with a maximum penalty and, in some cases, criminal sanctions.

This makes it essential to rely on your accountant, who is not only well-versed in the requirements and deadlines of the various tax types applicable to your business but is also up to date with the latest rules and processes, and how it affects your tax compliance.

“Employing an accountant, tax practitioner, or other tax professional to complete returns, or from whom to obtain advice before completing a return with entries that are not understood or adopting a position with tax implications” is among SARS’ recommended ways to ensure reasonable care has been taken by a taxpayer.

It is our best advice too for tax compliance throughout 2024.

How to Survive Ongoing High Interest Rates in 2024

“Inflation is bringing us true democracy. For the first time in history, luxuries and necessities are selling at the same price.” (Robert Orben, comedian and writer)

Interest rates and inflation are a nasty partnership that can, if managed badly, derail any small to medium enterprise. Their effects are felt in every area of the business and if they are not addressed correctly, high interest rates can have a significant impact on business, driving up costs, slowing growth and minimising competitive advantage.

Governments use high interest rates to manage the impacts of inflation. When inflation is growing, people should expect interest rates to do the same. Unfortunately, the global phenomena that have been driving increased inflation over the past few years show no signs of slowing down – the Ukraine war drags on leading to both oil and food supply issues, while supply chain issues and the pandemic’s grasp are both proving more difficult to overcome than expected. This has meant that economists have abandoned any hopes for lower rates in 2024 and have instead coined the mantra, “Higher for longer”.

What does this mean for your business in 2024?

- More difficulty borrowing: Rising interest rates leads to businesses paying more to borrow money and reduces the ability to pay debts that have already been incurred. High debt repayments may make it difficult to finance new expansion projects or invest in new products and services, which in turn can stifle growth.

- Less demand: Customers feel high inflation too. They may turn to buying cheaper products thereby eroding the competitive advantage your company once held, or they may give up on your service altogether. This too can have long-term impacts on growth plans and could severely impact cash flow.

- Declining reserves: Longer high interest rates may mean businesses are required to dip into their cash buffers to service debts or simply to cover costs as earnings slowly dip.

- Improved earnings on cash: Those companies with large cash reserves can see benefits in times of high interest as the return from banks improves.

- Faltering competition: Those companies in good standing may also find their competition struggling. This is the perfect time to seize additional market share.

How to thrive in high interest conditions

- Assess your weaknesses: Evaluate the risks associated with your business operations. Take into account elements like how sensitive your income sources are to economic fluctuations, dependence on particular clients or suppliers, and any external influences that could affect your financial strength. Recognizing potential risks and vulnerabilities empowers you to create tactics that lessen their effects when confronted with an interest rate increase.

- Trim expenses: It’s time to go through your monthly expenses and see where you can save. Are you getting the best deals on rental, internet, and office supplies? If your staff are largely working from home, can you afford to move into a smaller office? Consider outsourcing jobs that aren’t part of your core business – PR, designers, IT professionals and even HR and Admin are good places to start.

- Refinance debt: Take careful note of the debts you have. Is there some way you can refinance them to your benefit? If you are paying off a lot of small, high interest loans such as credit cards, it might be wise to see if you can consolidate them all under one larger, lower-interest debt. Understanding the details of your outstanding debts enables you to assess how an increase in interest rates might affect your monthly payments and overall financial commitments.

- Increase prices: If you have resisted raising prices thus far it might be time to take a look at whether an adjustment is in order. You are likely paying a lot more for your raw materials and supplies than you did a year ago, while delivery costs, advertising and everything else have been climbing as well. If you are managing with the lower prices, then is it possible to turn this to your advantage and aggressively market to snatch a greater portion of the market from competitors who just got a lot more expensive?

- Create a business buffer: Cash flow can be the biggest killer during times of high interest rates. Clients may be struggling to pay off their debts leading to you receiving late payments or even no payments at all if they go under. Consider applying for overdrafts or lines of credit so you are prepared should anything go wrong. If you are able, start building a cash buffer to further protect your company.

- Invest in marketing: Any additional money should go into advertising. The interest rates will eventually start dipping and when they do customers are going to go to the people who are most top of mind. According to a study conducted in 2018 by the Ehrenberg-Bass Institute, brands that halt their advertising efforts for extended periods typically encounter a 16% decline in sales within the initial year and a 25% decrease after two years.

However, this doesn’t mean simply throwing money away in the hopes of future income. Look at your product offering and focus on advertising those brands and items that might appeal to your clients in times of crisis. Remember, you may need to adjust the channels you market in as your customer’s purchase decisions on their media are likely to be impacted by increased pricing.

- Get expert advice: If you feel uncertain about scrutinising your financial records or evaluating your financial standing, ask your accountants for help. Their specialised knowledge can offer valuable perspectives and counsel customised to address your unique business requirements.

2024: Best Year Yet for Your Business?

“The best way to predict the future is to create it.” (Peter Drucker)

Facing what may well be another tough year, company owners and managers will be well aware that many of the external challenges will be beyond their control.

Fortunately, what remains under your control is how this new year is approached and starting 2024 with a thorough understanding of the three metrics below will ensure that this could be the best year yet for your business –

- The business’ past performance,

- Its current status, and

- Its mission for the new year.

You don’t need an MBA or special knowledge to assess the company’s past performance, to understand the present situation, or to plan for the year ahead. Just schedule some time with your accountant, take inventory of what’s truly going on in your business and decide how to make 2024 your best year yet.

Assessing the past

An assessment of the company’s performance over previous years provides invaluable information about what is working and what needs to be changed.

A relatively quick and easy way of assessing the past performance is looking at the business accounts and financial reports.

- For example, your profit and loss (P&L) statement, or income statement, will reveal reasons for periods when net losses were recorded (for example, slow business periods or extraordinary expenses) as well as raise red flags where expenses regularly exceed income.

- A balance sheet summarises total assets and total liabilities, showing the company’s financial position and measuring liquidity or ability to pay short-term liabilities.

- Summarising expected cash inflows and outflows over a period, a cashflow report reveals where the most cash is generated and used; highlights potential cash flow problems and enables informed budgeting and spending decisions.

- Regular debtors’ reports enable proactive management of current and overdue invoices to improve cashflow. Similarly, budget vs actual spend reports compare actual spending to the amounts budgeted for the period, to reveal areas over or under budget and to flag problem areas.

Determine where the business is now

Review the business operations, successes and challenges, and the reasons for missed targets, whether simply drawing on paper or using special software. Understand the company’s current capacity for production and its performance – how many targets met, on target and/or overdue. This enables current strategies, practices and operations to be evaluated, and to pinpoint what is working or not.

Also look at customer satisfaction and retention rates, as well as employee satisfaction, both of which can be assessed through electronic surveys or simply speaking to clients and staff.

Planning ahead

Building on what’s working and realising that doing things differently is the only way to achieve different results, you can choose the goals that will create the future of your business.

Specific, Measurable, Achievable, Relevant and Time bound goals – or SMART goals – focus your team’s efforts and increase the chances of successfully achieving the targets, particularly if these are supported by step-by-step plans, a budget for the required resources, accountability assigned to specific people, and ongoing reviews to track progress.

SMART goals are crucial for achieving success, as they provide a clear focus, specific targets to work towards and motivation for the entire team.

Assistance is at hand

Your accountant will be able to assist you with the financial reports that will allow you to assess the past and present, with advice in respect of tracking non-financial metrics, and with planning for the year ahead – so remember: help is at hand to ensure you approach 2024 with clarity and a solid plan to make it your company’s best year yet.