Your Tax Deadlines for March 2024

- 07 March – Monthly Pay-As-You-Earn (PAYE) submissions and payments

- 25 March – VAT manual submissions and payments

- 27 March – Excise duty payments

- 28 March – End of the 2023/24 Financial year, Value-Added Tax (VAT) electronic submissions and payments, & CIT Provisional payments where applicable.

Budget 2024: How It Affects You and Your Business

“Our bigger challenge… is that our pie is not growing fast enough and this limits our ability to generate sufficient revenues to distribute among our priority areas.” (Finance Minister Enoch Godongwana – Budget 2024)

Finance Minister Enoch Godongwana’s third Budget Speech in an election year contained few surprises, but also little in the form of good news, especially for South Africa’s personal income tax payers.

The Minister quoted dismal local average expected real GDP growth of 0.6% for 2023, which is projected to reach 1.6% between 2024 and 2026. This poor economic performance is ascribed to the persistent constraints in electricity supply and freight, rail and ports, as well as a high sovereign credit risk.

And the result? A sharp drop in tax revenue collection for 2023/24 which, at R1.73 trillion, is R56.1 billion lower than estimated!

To make up the shortfall, Budget 2024 contains tax measures that will raise an additional R15 billion in 2024/2025, mainly through income tax raised by not adjusting personal tax brackets, rebates and medical tax credits for inflation, as well as above-inflation increases in alcohol and tobacco excise duties.

Other main proposals included no increase to the general fuel levy for 2024/25, a global tax on multinational companies in South Africa with an annual revenue exceeding €750 million and the R150 billion withdrawal from SA’s Gold and Foreign Exchange Contingency Reserve Account.

These announcements are briefly detailed below, along with some of the other announcements that will impact individuals and businesses.

Budget proposals that will impact you

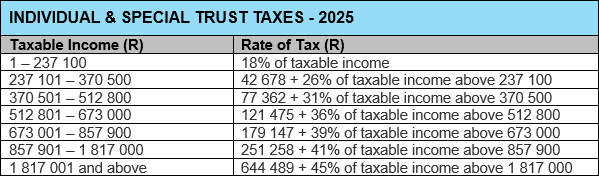

- Addressing the Budget shortfall, personal income tax brackets are not adjusted for inflation – so individuals who received a salary increase this year are likely to pay more tax as they could fall into a higher tax bracket.

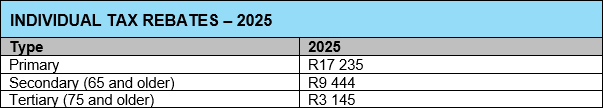

- No inflation adjustments to the tax rebates.

- Medical tax credits per month are not increased by inflation.

- A one-year extension in the R350 Social Relief of Distress (SRD) grant and increases ranging from R20 to R100 per month in other social grants.

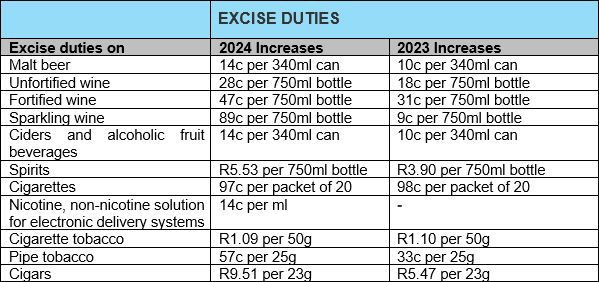

- Above-inflation increases in the excise duties on alcohol and increases of between 4.7 and 8.2% on tobacco products. This means that the duty on:

- a 340ml can of beer increases by 14c,

- a 750ml bottle of wine goes up by 28c,

- a 750ml bottle of fortified wine goes up by 47c,

- a 750ml bottle of spirits will increase by R5.53,

- a 23g cigar goes up by R9.51,

- a pack of 20 cigarettes, rises by 97c,

- vaping products increase to R3.04 per millilitre.

- Two-pot retirement reform to be implemented on 1 September 2024, allowing individuals access to a portion of their retirement savings before their retirement date.

Budget proposals that will impact your business

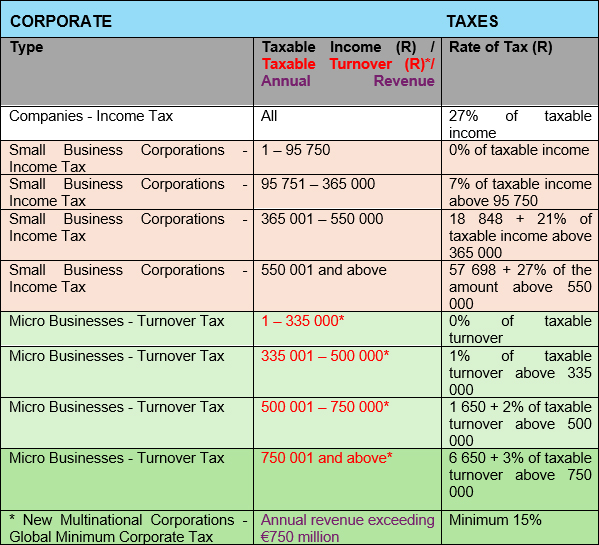

- A global minimum corporate tax will be implemented from 1 January 2024, with multinational corporations with an annual revenue exceeding €750 million subject to an effective tax rate of at least 15%, regardless of where their profits are located. This will broaden the corporate tax base, enabling more tax revenue collection without increasing existing corporate taxes for local businesses. This new tax is expected to increase corporate tax collection by R8 billion in the 2026 tax year.

- An increase in the limit for renewable energy projects that can qualify for the carbon offsets regime, from 15 megawatts to 30 megawatts.

- An electrical and hydrogen-powered vehicle tax incentive introduced for manufacturers in 2026, enabling them to claim 150% of qualifying investment spending.

- An increase in the carbon tax from R159 to R190 per tonne of CO2 equivalent from 1 January 2024.

Budget proposals that will impact all

- The general fuel levy and the Road Accident Fund levy will not be increased this year, providing tax relief of R4 billion.

- However, the carbon fuel levy will increase to 11c per litre for petrol and 14c per litre for diesel effective from 3 April 2024.

- Plastic bag levy to increase to 32c per bag from 1 April 2024.

- The R150 billion withdrawal from SA’s Gold and Foreign Exchange Contingency Reserve Account to pay down government debt.

How best to manage your taxes going forward?

In addition to the announcements detailed above, other technical amendments proposed in the Budget 2024 may also require professional tax advice.

Furthermore, as tax collection remains government’s main source of income, you would be well-advised to rely on our expertise and advice as we determine the impact of the Budget 2024 announcements on your tax affairs.

Budget 2024: Your Tax Tables and Tax Calculator

Budget 2024 effectively brought an increase in personal income tax by not adjusting the tables for tax rates, rebates and medical tax credits, while also implementing substantial increases in ‘sin’ taxes and introducing a proposed global tax on multinational companies.

This selection of official SARS Tax Tables and other useful resources will help clarify your tax position for the new tax year. Then follow the link to Fin 24’s Budget Calculator (just follow the four-step process) to perform your own calculation.

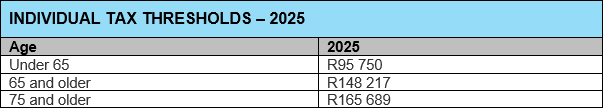

Individual taxpayers – tax tables unchanged

Source: SARS

Source: SARS

Source: SARS

Businesses – Corporate tax rates – extended

Sources: SARS’ Budget Tax Guide 2024; Budget Speech 2024

Sin taxes increased

Source: Budget 2024 People’s Guide

How much will you be paying in income, petrol and sin taxes?

Use Fin 24’s four-step Budget Calculator here to find out the monthly and annual impact on your income tax, as well as what you will pay in future in terms of fuel and sin taxes, bearing in mind that the best way to fully understand the impact of the announcements in Budget 2024 on your own and your business affairs is to reach out to us for professional advice.