The 2025 Tax Filing Season Opens on 7 July

“My sincere gratitude goes to the compliant taxpayers and traders who have continuously played their part in building our country. Ndza khenza.” (SARS Commissioner, Edward Kieswetter)

| Tax Filing Season 2025 officially opens on 7 July this year. This covers the 2024/2025 year of assessment: the period between 1 March 2024 and 28 February 2025.

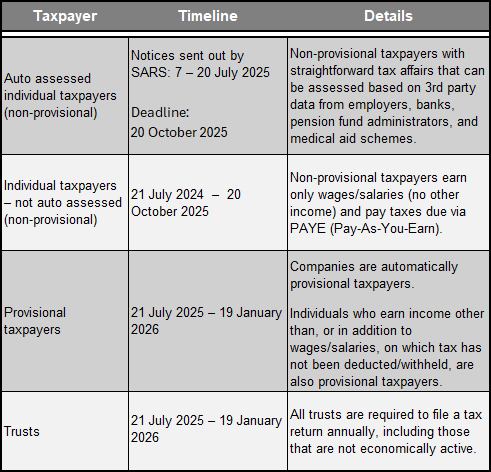

During filing season, taxpayers complete and submit their tax returns, declaring their income and deductions to allow SARS to determine their final tax liability for the period under assessment. This year, for the first time, the majority of non-provisional taxpayers will be automatically assessed. Dates to diarise

Auto assessed? Here’s what to do…

Non-provisional taxpayers who are not auto assessed can start filing their tax returns from 21July 2025 until 20 October 2025. Provisional taxpayers (certain individual taxpayers and all companies) as well as trusts can start filing returns from 21July 2025 until 19 January 2026.

Fortunately, our team of seasoned tax professionals is ready to ensure you tick all these boxes. Let’s make this filing season an easy one! |

Don’t Let Your Best Ideas Go: Why You Must Protect Your Intellectual Capital

“Too many businesses only realise the value of intellectual capital when a key person leaves – or a competitor copies what they’ve built.” (Alicia Mendes, author of Futureproofing Through People)

In the rush to raise capital, improve profitability or streamline efficiency, business owners often miss what truly drives their success: the knowledge, relationships, and systems that power everything behind the scenes.

Whether you’re a one-person start-up or a growing enterprise, your intellectual capital is the secret key to your future triumphs. It is therefore vital that this intangible resource is protected before it vanishes. Doing so could be the most profitable decision you ever make.

Understanding intellectual capital

Intellectual capital is grouped into three categories: human capital (skills and experience), structural capital (systems, intellectual property (IP), databases) and relational capital (customer relationships, brand reputation and partnerships).

A recent study by Ocean Tomo revealed that intellectual capital now constitutes approximately 90% of the S&P 500’s market value – a significant increase from 68% in 1995. That includes patents, know-how, trade secrets, brand equity, and team knowledge.

With numbers like this, it’s absolutely essential that you audit your intellectual capital just as you would your balance sheet. What processes are unique to you? Who on your team holds key relationships or institutional memory? Are your best ideas captured anywhere, or do they leave when someone resigns?

Culture and contracts

You have to understand that your people are the carriers of knowledge. Their experience, relationships with clients, and systems know-how can be invaluable. Unless you plan carefully, when someone leaves they often take that intellectual capital with them.

Retention doesn’t just come from compensation. It comes from fostering a culture of recognition, curiosity, and inclusion. The 2023 Gallup “State of the Global Workplace Report” stated that, “employees who have had opportunities to learn and grow are 2.9 times more likely to be engaged.” It is therefore essential that you ask your accountant to make space in your budget for learning programs, and other leadership developing initiatives.

But culture alone isn’t enough. It’s important to also back up your culture with a legal framework that protects you. This includes NDAs (non-disclosure agreements), IP assignment agreements, and clear clauses in employment contracts covering confidentiality and ownership of work.

Capture knowledge before it walks

Most businesses operate through a web of undocumented processes from verbal know-how, to “we’ve always done it this way” workflows. That’s risky.

Developing internal playbooks, knowledge bases, and SOPs (standard operating procedures) is one of the most effective ways to turn intellectual capital into something transferrable and scalable.

Use tools like Notion, Confluence, or even simple shared drives to document repeatable knowledge. Then embed this into your onboarding and training cycles.

Nurture innovation and learning

Intellectual capital isn’t static. Like any asset, it can appreciate or depreciate. One of the best ways to nurture it is by creating space for learning, experimentation, and cross-pollination of ideas.

Encourage teams to attend industry events, run internal hackathons, and allocate budget to learning and development. Even better, reward creative problem-solving that moves the business forward.

Make intellectual capital part of your valuation

It’s vital that your intellectual capital becomes a cornerstone of your company valuation. Whether you’re pitching to investors, selling your business, or applying for funding, it’s important that you document your competitive advantages. Have you built a repeatable system others can’t match? Developed internal tools that boost efficiency? Retained staff with rare skills? All of this translates into value.

Only by showing how your business can thrive even if the best individuals leave, can you give future investors the knowledge they need to trust you.

Protect what really drives value

Tangible assets can be insured. Cash can be raised. But your intellectual capital requires conscious attention and care. Whether you’re building your first business or scaling your fifth, now is the time to treat your brainpower like the goldmine it is.

PAIA ANNUAL REPORT – SUBSMISSION DEADLINE 30 JUNE

Information Regulator has issued a formal notice requiring the submission of Annual Reports in terms of the Promotion of Access to Information Act (PAIA), 2 of 2000, for the 2024/2025 financial year

As per Section 32 of PAIA, all Information Officers (IOs), Heads of Private Bodies (HPBs), and Deputy Information Officers (DIOs) are required to submit an annual report detailing requests for access to records received and processed. Non-compliance may result in regulatory enforcement actions, including formal compliance audits initiated by the Information Regulator.

Submission Process

- Reports must be submitted via the Information Regulator eServices Portal.

- Only registered IOs, HPBs, and DIOs are authorized to submit reports.

- Failure to submit may then trigger mandatory PAIA compliance checks.

Consequences of Non-Compliance

Failure to comply with PAIA reporting obligations may result in:

- Regulatory enforcement notices issued by the Information Regulator.

- Potential fines or criminal penalties, including imprisonment for up to three years for wilful or negligent non-compliance.

- Reputational damage, which may discourage stakeholders from engaging with your organization.

Timely submission is imperative to avoid regulatory scrutiny and enforcement measures. Please ensure compliance before the deadline.