How to Achieve Tax Compliance Throughout 2024

“SARS is willing and ready to assist taxpayers who want to be compliant. Where taxpayers willfully and intentionally ignore their legal obligations, SARS will act sternly.” (SARS Commissioner Edward Kieswetter)

Businesses are often required to share their tax compliance status, for example for a tender application, bidding process or prequalification as a supplier; to confirm that their tax affairs are in order with SARS; to receive payment; or for foreign investment allowances.

This is because proof of tax compliance is accepted as an indicator of how well a company is managed and its good standing in terms of its legal obligations. Tax compliance also saves time and money.

SARS provides clear advice to owners of small, micro and medium enterprises (SMMEs) on how to achieve tax compliance, both in the business and in their personal capacity, including a recommendation to seek the advice of an accountant.

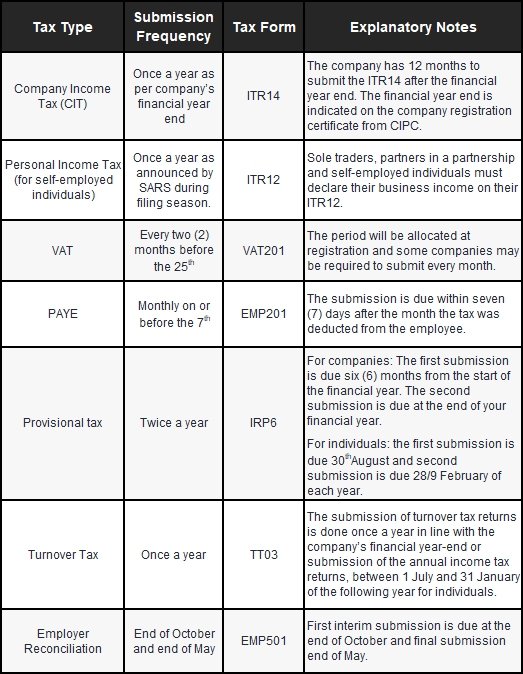

Which tax types apply to you and your business?

This handy table from SARS details the tax types that generally apply to SMME businesses and their owners.

Source: SARS

Compliance life cycle

The “compliance life cycle” as SARS calls it, applies to each one of the tax types for which the business and the owner are liable.

It involves completing these steps in your tax relationship with SARS from beginning to end:

- Registration on SARS’ system for each tax type applicable;

- Timely and correct declarations or returns for each tax type, including submitting relevant supporting documents;

- Timely payments where a tax liability exists; and

- Deregistration from tax types if the business is liquidated or closed.

To meet these requirements consistently across all the relevant tax types over the tax year, in an always-changing tax landscape, taxpayers should consider professional assistance.

Consequences of non-compliance

Non-compliance is a costly choice, generally involving penalties and interest, as well as additional fees to rectify, and potentially further losses, such as losing a business opportunity or the confidence of clients, stakeholders and investors, or suffering reputational damage.

In addition, not registering for a tax type to evade paying taxes, as well as the non-submission of tax returns are criminal offences, which may result in a fine, imprisonment or both.

Outstanding returns will also negatively affect tax compliance status, and administrative penalties that will attract interest may be incurred for non-submission.

Where tax liabilities have not been paid, and no payment arrangement has been made, penalties and interest will also apply, tax compliance status will be affected, and SARS may appoint third parties, such as a registered bank, to recover the outstanding tax.

Ensuring compliance

Human errors and simple mistakes are common given the complex tax types, rules and strict deadlines. Nevertheless, a taxpayer can be found guilty of an offence without SARS having to show that the taxpayer committed it wilfully, deliberately and knowingly. It means that even unintentional or administrative errors can be penalised with a maximum penalty and, in some cases, criminal sanctions.

This makes it essential to rely on your accountant, who is not only well-versed in the requirements and deadlines of the various tax types applicable to your business but is also up to date with the latest rules and processes, and how it affects your tax compliance.

“Employing an accountant, tax practitioner, or other tax professional to complete returns, or from whom to obtain advice before completing a return with entries that are not understood or adopting a position with tax implications” is among SARS’ recommended ways to ensure reasonable care has been taken by a taxpayer.

It is our best advice too for tax compliance throughout 2024.