How the New Assessed Loss Tax Limitation Works

“People who complain about taxes can be divided into two classes: men and women.” (Unknown)

The assessed loss rules have always allowed companies to deduct from their taxable income each year any assessed losses from previous years. The remaining assessed loss balances could be carried forward indefinitely. This meant that a company would only pay income tax once it made a taxable profit and all previous assessed losses had been deducted from the taxable income.

These rules have changed and may affect your next income tax bill.

What’s new?

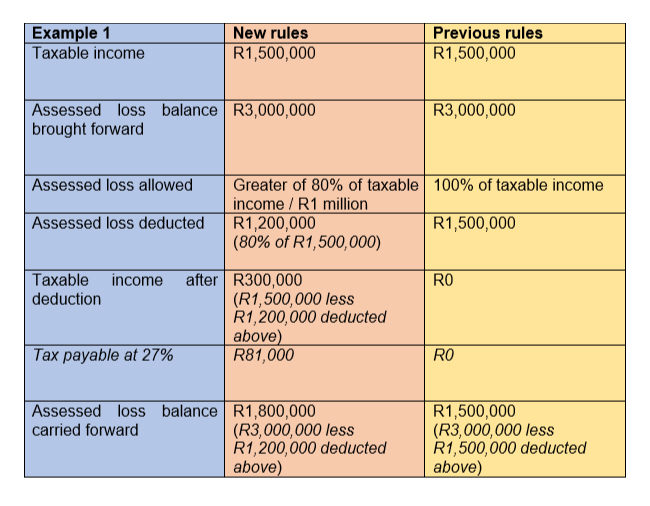

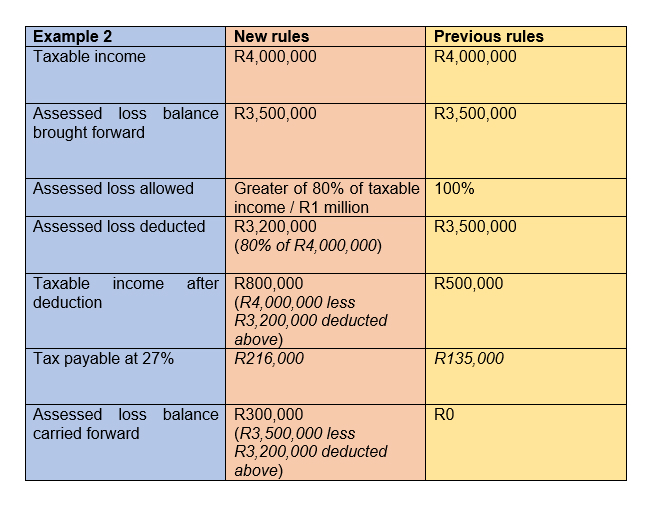

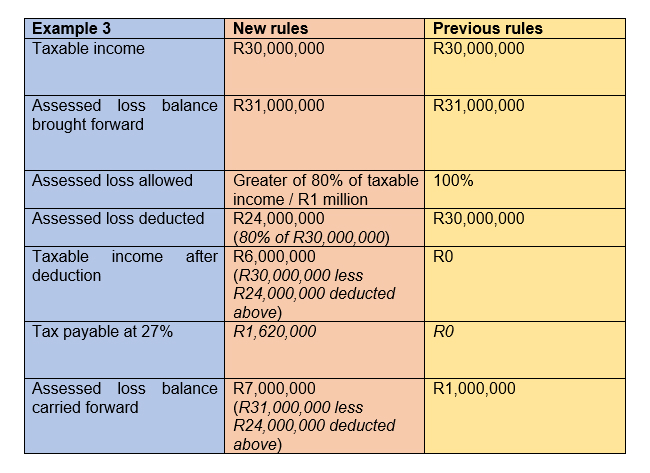

Under the new rules, assessed losses brought forward from a previous year of assessment can only be offset against a maximum of 80% of the current year’s taxable income or R1 million, whichever is higher.

This means that many companies will now pay income tax on up to 20% of the taxable income for the year if it exceeds R1 million, even if the assessed loss balance carried forward from previous years far exceeds the taxable income. Adjust your cash flow forecasts accordingly.

What you should know

- The new rules apply to any year of assessment that began on 1 April 2022 onwards and that ends on or after 31 March 2023.

- The new limitation applies to a company’s assessed loss balance as at 1 April 2022, and not only to assessed losses accumulated after this date.

- Companies do not lose the balance of an assessed loss that could not be utilised in one tax year, it is just carried forward to the next tax year.

- If a company does not trade for a full year of assessment and no income is earned from such trade, the assessed loss balance will be lost.

- Further complex rules may apply in certain circumstances, for example, the 3-out-of-5-years rule and the ring-fencing of losses if a business carries on one of the listed “suspect trades”, which means professional advice is essential when deducting an assessed loss against taxable income.

Will your tax bill be affected?

Some companies will not be affected immediately, for example:

- Companies that made a loss during the year and therefore have no taxable income to reduce;

- Companies that do not have an assessed loss balance brought forward; and

- Smaller companies with a taxable income below R1 million are not affected by the new rules and can still deduct the full balance of an assessed loss against 100% of their taxable income.

However, the changes will have tax cash flow implications for other companies. The examples below illustrate this.

|

|

|

Both the old and the new rules are complex. In addition, some of the wording in the legislation still needs to be clarified, so speak to your accountant about the impact the new rules will have on your next tax bill.