Home Office Expenses: To Claim or Not to Claim?

“We would simply ask taxpayers to consider carefully the longer-term implication of defining an area in their primary residence as a home office for tax purposes” (Edward Kieswetter – SARS Commissioner)

“All employers should allow their employees to work from home unless it is absolutely necessary for them to perform work on-site” was among the government’s directives issued on 28 June, when South Africa was placed under an adjusted Alert Level 4 lockdown in response to the third wave of Covid-19 infections in the country.

While working from home has certainly become a more familiar feature of the employment landscape and is predicted to remain so long after all lockdown restrictions are lifted, it has been some time since employees were actually compelled to work from home wherever possible.

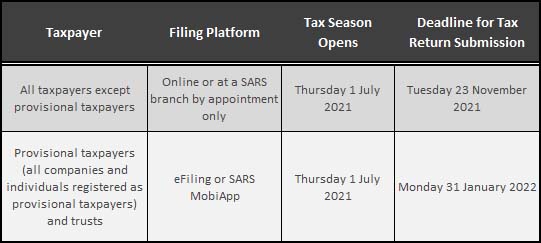

This, along with the opening of the 2021 tax season on 1 July, refocussed attention on the issue of home office expenses and how these should be treated for an optimal tax outcome for employees and employers.

Just days later after the lockdown commenced, SARS announced that it had published an update on its website in relation to home office expenses to provide “additional clarity for individual taxpayers who may be considering submitting claims for home office expenses in their income tax returns that can now be filed for the 2021 tax year” from 1 March 2020 to 28 February 2021.

What has changed?

SARS notes that expenses in maintaining a home office have been a controversial issue since the 1968 judgment KBI v Van der Walt. The legislative provision relating to home office expenditure that a taxpayer may claim, section 23(b) of the Income Tax Act, has therefore been periodically amended since 1990.

However, since March 2020, things have changes drastically due to Covid-19, and more employees have been compelled to spend more time than ever before working from home. It is in any case likely to be a permanent feature of the employment landscape in the future. Employees have been accommodating this shift by setting up home offices and bearing certain expenses to create and maintain a proper working environment at home.

Despite the substantial change in the employment landscape, SARS emphasized in their media statement that “there have been no changes to the legislation in relation to a ‘home office’… the legal requirements remain the same as before the Covid-19 pandemic.”

However, in May, SARS also issued a 17-page draft Interpretation Note 28 (IN28) on what taxpayers who are “in employment or holding an office” can deduct for home office expenses, providing various examples of when expenses will not be permitted. These include, for example, working at a dining room table instead of in a dedicated room; or also using the home office space for purposes other than working.

Media comments have suggested that the draft interpretations are narrow, excluding most employees from claiming a tax deduction; do not adequately address tax implications arising from the increase in home office use due to Covid-19; and do not align with National Treasury’s intention, expressed in the February Budget Review, to investigate current travel and home office allowances for “efficacy, equity in application, simplicity of use, certainty for taxpayers and compatibility with environmental objectives”.

While the Draft Interpretation is under discussion, SARS says that the legal requirements set out in the Income Tax Act remain the same as before the Covid-19 pandemic.

6 questions to determine if you are eligible to claim home office expenses

SARS’ “Home Offices Expenses Questionnaire” here says that answering ‘Yes’ to all 6 questions below confirms eligibility to claim home office expenses.

- Did you receive remuneration for duties performed mainly (more than 50%) in part of your private premises occupied for purposes of that remuneration?

- Do you have a dedicated room in your premises?

- Is this room specifically equipped for the purpose of that remuneration?

- Is this room regularly used for purposes of performing the duties in relation to that remuneration?

- Is this room exclusively used for purposes of performing the duties in relation to that remuneration?

- Did you incur home office expenditure relating to your domestic premises?

Just please read the “Pitfalls” section below before making any decisions!

What can and cannot be claimed?

For a home office expense to be deductible, the requirements of the Income Tax Act must be met and its prohibitions must not apply.

Typically, home office expenditure includes rental of the premises; cost of repairs to the premises; and expenses in connection with the premises.

This means that taxpayers may deduct rental or bond interest on the home and home repairs; municipal rates, electricity and water; wear and tear on office equipment considering differing depreciation rates on computer equipment and office furniture.

In terms of the rental or bond, as well as the municipal rates and utilities, an apportionment of the costs must be made when claiming. This is typically calculated on a pro-rated basis of floor space i.e. square metre basis of the home office in relation to the total area of the home.

Employees may also incur numerous costs in running a home office such as telephones and cell phones, Internet connectivity, equipment repairs, stationery, and cleaning.

Beware the pitfalls

- The specific wording, narrow interpretations and possible changes to home office expenses could place taxpayers at risk. For example, to claim home office expenses, the home office must be a room “dedicated” to work where duties are performed “mainly’ or “more than 50% of the time”, and it must also be “specifically equipped” and “regularly” and “exclusively” used for work. Wording such as this, along with possible changes and the narrow interpretations suggested in the most recent draft Interpretation Note (IN28) should prompt employers and employees to take professional advice before deciding to claim a tax deduction in respect of home office expenses.

- The burden of proof lies with you as taxpayer. Employees should be provided with written confirmation regarding the specific timeframe they are required to work from home. In addition, employees should keep a running spreadsheet of hours and days worked at home covering the entire tax year, or consider other solutions such as keyboard tracking software, stealth monitoring or mobile time clocking solutions.

- Home office expenses must be linked to employment use and must be verifiable. Be sure to retain invoices and statements of all home office expenses. Where expenses are not specified as deductible in the Income Tax Act, opting for reimbursement by your employer may be a more efficient solution.

- The possible impact on capital gains tax. SARS warns that where the home office is on taxpayer-owned property, formally defining part of a primary residence as a home office will ‘most likely have an adverse impact on a future capital gains determination’. This is because the home office area will, on a pro-rated basis, be excluded from the primary residence exclusion of R2 million on disposal of the residence. Careful consideration should therefore be given before a claim for home office expenses is made and it is essential to get professional advice on this aspect.

- Increased risk of being audited. SARS warns that while all claims for home office expenses may be subject to further verification or audit, there is a high likelihood that a taxpayer who claims home office expenses for the first time will be selected for verification or audit.

Cost vs Benefit Analysis

Given all the potential pitfalls, it is important for employers and employees to consider whether the cost, risk and administration involved in claiming home office expenses are worth the benefit received in terms of the total tax deduction.

Other options should also be explored to ensure the optimal tax outcome for employers and employees. For example, should the employer provide the employee with an allowance per month to cover home office expenses, such an allowance will be taxed as part of their remuneration. Where the employer reimburses such expenses, however, it would not be taxable in the employee’s hands. Similarly, if the employer reimburses expenses for the purchase of home office equipment, such equipment is then the property of the employer and would also not be taxable in the employee’s hands. Employers should consider a reimbursement policy to clarify the treatment and maximum reimbursement amounts and are strongly advised to obtain advice from their accountant when making these decisions.

SARS itself notes that taxpayers may find that working from home resulted in savings on expenses they would otherwise have incurred, like transport, wear and tear on vehicles and so forth. These savings, together with the loss of part of the capital gains exclusion, may outweigh the benefit of a claim for home office expenses.

“We understand that many employers, and employees alike, are grappling with establishing a new normal,” says SARS Commissioner Edward Kieswetter. “We would simply ask taxpayers to consider carefully the longer-term implication of defining an area in their primary residence as a home office for tax purposes. It may be more prudent to wait and establish a more sustainable rhythm before making the decision” (Emphasis supplied).