The urban development zone (UDZ) tax incentive, provided for in section 13quat of the Income Tax Act (the Act), was introduced 20 years ago in 2003, as an accelerated depreciation allowance for property investments in certain central business districts. It aims to promote investment by the private sector in the construction or improvement of commercial and residential buildings, including low-cost housing units, situated within demarcated UDZs.

In the most recent 2023 Budget, this incentive was extended for another two years, to allow for the completion of a review of the incentive, which has yielded some successes, by motivating investment in South Africa’s cities. We briefly overview below what the tax incentive entails and the criteria that must be met, where it applies and other issues to take note of when deciding if it could benefit your business before it expires at the end of March 2025.

What the UDZ tax incentive entails

Individuals and companies investing in residential or commercial property in South Africa’s urban zones from which to carry on a trade, should carefully consider the UDZ tax incentive before deciding where to buy.

This tax allowance, when deducted, can substantially reduce the taxable income of a taxpayer, and – because the allowance is not limited to the taxpayer’s taxable income – can create an assessed loss.

However, five specific criteria must all be met before the allowance is granted. In addition, only certain costs can be considered for the purposes of the allowance. These are listed below, along with the UDZs listed by SARS, and some further issues to take note of.

Five criteria to be met

- Building requirement – The building must meet certain requirements, and only the cost of the erection, extension, addition to or improvement of the building, covering either the entire building or a floor area of at least 1,000m2 qualifies. Land costs are excluded.

- Urban development zone requirement – The building must be located within a UDZ.

- Trade requirement – A taxpayer will qualify for the allowance only if the relevant commercial or residential building or part of the building is used by the taxpayer solely for the purposes of trade, and only once the building has been brought into this use.

- Owner requirement – The building or part of the building that was erected, extended, added to or improved must be owned by the taxpayer deducting the allowance. Where the building or part of a building was purchased directly from a developer within three years after completion, an allowance may be deducted, provided the developer did not deduct any allowance, among other criteria.

- Date requirements – There are specified dates to which the allowance applies, including a commencement date requirement and a trade date requirement.

Costs that may be considered – and those that are not

- Construction work

- Architect and approval fees

- Sidewalks

- Parking for the building

- Landscaping as part of the development (including earthworks, greenery and irrigation)

- Drainage

- Security (fences, cameras and surveillance equipment)

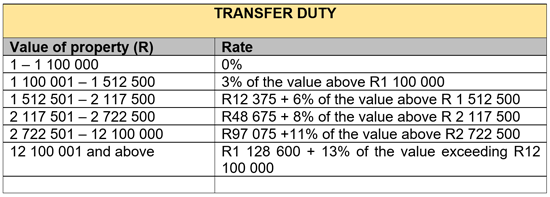

Costs specifically excluded are the purchase price of the land, VAT and transfer duty, financing charges, agent’s commission and transfer and related legal costs.

Where does the UDZ tax incentive apply?

- Buffalo City

- City of Cape Town

- Ekurhuleni

- Emalahleni

- Emfuleni

- eThekwini

- Johannesburg

- Mangaung

- Matjhabeng

- Mbombela

- Msunduzi

- Nelson Mandela Bay

- Polokwane

- Sol Plaatje

- Tshwane Metro

Source: SARS

Other issues to take note of

- Depending on the type of development involved – new, improved or low-cost – the allowance is calculated at a different rate of depreciation, providing for 20 – 25% of the costs allowed to be deducted in the first year, and the remainder over one to ten years.

- When purchasing a building or part of a building from a developer, 55% of the purchase price of a new building, or 30% of the purchase price of a building improved will be allowed as costs for purposes of the UDZ incentive.

- The UDZ incentive is an accelerated depreciation allowance, and not an additional tax allowance. A taxpayer claiming a UDZ deduction may not claim any other deductions on that building or part of the building.

- For each building or part of a building on which the allowance is being deducted, you will need the necessary UDZ forms (UDZ 1, 2, 3 and 4 forms), as well as a location certificate and, where applicable, a certificate of occupation.

Taking advantage of this tax incentive, if it applies to you, could mean a difference of millions of rands to your future tax bill. However, this is a very complex tax incentive and there are many issues to be considered.

It is highly recommended that business owners consult with their accounting and tax practitioners to find out if they would qualify for the maximum allowance when investing in a UDZ, and to do so while still ticking all the compliance boxes.