Letter of Demand from SARS? Handle With Care!

“A senior SARS official may authorise the issue of a notice to a person who holds or owes or will hold or owe any money, including a pension, salary, wage or other remuneration, for or to a taxpayer, requiring the person to pay the money to SARS in satisfaction of the taxpayer’s outstanding tax debt” (Tax Administration Act)

For many South African companies – already battered by loadshedding, lockdowns and looting – a letter of demand from SARS could be the last straw. For others it may be the entry point into one of the many scams that use letters of demand pretending to originate from SARS. For others still, it may be a signal that the company’s internal compliance procedures are lacking. And, in two recent court cases (refer below), the manner in which the letter of demand was delivered proved to be an important safeguard for the companies that experienced SARS simply deducting the outstanding tax debt from their bank accounts!

Regardless of the circumstances, any letter of demand from – or seemingly from – SARS should be handled with care!

What a SARS Letter of Demand means

Among the mechanisms increasingly applied by SARS to increase tax debt collection is the issuing of letters of demand to taxpayers.

A letter of demand is sent by SARS when a taxpayer has not paid the amount due to SARS by the deadline date as specified in a notice of assessment previously sent to the taxpayer. A letter of demand may also be issued in respect of late, missed or incorrect VAT or PAYE payments.

These outstanding tax debts may not necessarily be new – or even recent – but can span over a period of years.

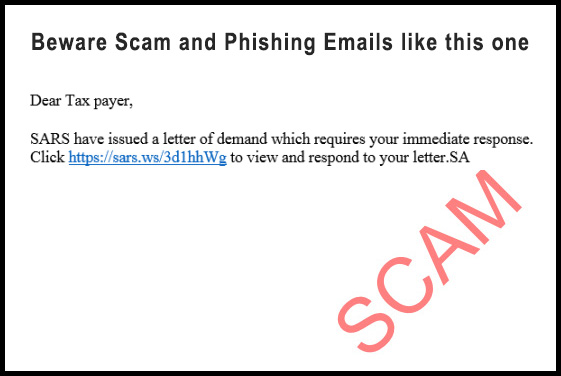

It could also be a scam. Realising that many taxpayers panic when receiving such a letter of demand, criminals have seized the opportunity, with numerous scams doing the rounds. See just one example below from SARS’ website –

See more examples on the SARS “Scams & Phishing” webpage.

These letter of demand scams involve email and SMS communications seemingly from SARS with links to fake websites that scam people into sharing confidential information such as bank account details, which is then used fraudulently.

A letter of demand from SARS could also indicate problems with a company’s internal tax compliance processes, for example, that taxes due are not correctly calculated internally, that incorrect amounts are being paid over to SARS, or that taxes due are being paid late – or not at all.

It is also possible that the letter of demand could have been issued by SARS erroneously. Perhaps the outstanding amount has already been paid but not correctly allocated, or perhaps the outstanding amount as calculated by SARS is incorrect.

If a taxpayer fails to respond to the letter of demand within the deadline specified, SARS can legally commence with collection measures. These can include third-party payment appointments enabling the outstanding tax amount to be deducted from a taxpayer’s bank account or income, or assets being attached by the sheriff of the court, or – in the worst-case scenario – the liquidation of a company to recover the debt.

Among these measures, recovering outstanding tax debts directly from the taxpayer’s bank account is a quick and effective collection tool, but one that can leave taxpayers facing severe financial hardship.

In this respect, a letter of demand can also be a crucial safeguard for taxpayers. In two recent court cases the courts overturned SARS’ instructions to the respective third-party banking institutions to debit the taxpayers’ bank accounts with the outstanding tax debt and ordered SARS to repay the amounts with interest.

Pivotal to the taxpayers’ success in both these cases was the fact that in terms of the Tax Administration Act (the “Act”), a letter of demand must be delivered to the taxpayer either through the eFiling system or to the last known physical address at least 10 business days before SARS proceeds with debt collection. The letter of demand must also set out the recovery steps that SARS may take if the tax debt is not paid by the deadline date, as well as the available debt relief mechanisms under the Act.

How to handle a letter of demand

Realising all these various possible scenarios under which a company might receive a letter of demand, business owners and managers will understand the importance of an informed, professional and swift approach.

Firstly, it is crucial to understand what remedies are available to taxpayers facing a letter of demand –

- Where the amount outstanding is undisputed, and the company has sufficient resources, simply paying the full outstanding tax debt within the specified timeframe will prevent SARS from taking further action.

- Where the amount outstanding is undisputed, and the company can demonstrate short-term cash flow challenges that prevents the settlement of the tax debt in one payment or by the deadline date specified, application for an instalment payment arrangement can be made.

- Where the amount of the tax debt is undisputed, but the company is unable to pay the amount, the company can submit a Compromise of Tax Debt application which can reduce the tax liability to an affordable amount to be paid off over time.

- If the company intends to or has submitted a formal dispute and does not have sufficient resources to pay the outstanding amount, it can submit a request for suspension of payment prepared by an accountant or tax practitioner. If approved, the collection of the tax debt is suspended until 10 business days after SARS informed the taxpayer of its decision regarding the dispute.

- Taxpayers can apply for settlement of a disputed tax debt in terms of section 146 of the Act to save time and costs.

Secondly, a professional approach remains the best policy. If SARS is approached professionally and timeously, using the correct and legal processes, taxpayers will often find that SARS is willing to both guide and assist.

It is also helpful to realise that SARS’ debt collection department is a separate business unit, uninvolved with normal tax processes. It will pursue its objective of collecting outstanding tax debts whether these are disputed or not unless a suspension has been granted. The advice and assistance of a qualified accountant or tax practitioner will not only ensure the correct remedy is applied but will also save time and costs.

Thirdly, swift action is essential. While all correspondence received from SARS should be immediately addressed with the assistance of your accountant or tax practitioner, time is of the essence in respect of letters of demand.

Remember that the “pay-now-argue-later” principle applies to all tax debts, whether or not an objection or appeal has been lodged. Furthermore, a legitimate letter of demand is a warning that SARS will commence with legally allowed collection measures after the specified deadline. Failure to respond to this letter within the specified timeframe, can have dire and expensive consequences. Don’t delay!

What steps you need to take

- Ensure that your company information saved on the eFiling platform is accurate and current so urgent communications from SARS, which are sent via the eFiling platform, always reaches the right person. Check also that all email and contact details are correct.

- Check your eFiling profile regularly to be sure that you don’t miss any correspondence from SARS.

- Establish validity by checking all the details on the letter of demand. Is the letter correctly addressed to the taxpayer? Is the tax number correct? When was the letter issued? Was it delivered via eFiling or to a physical address?

- Check the amount of the tax debt allegedly due to SARS, starting by downloading a Statement of Account from your SARS eFiling profile. Further internal investigation may be required.

- Note the time limit within which to take the next step – SARS usually allows the taxpayer 5 to 10 business days to respond. Failing to respond within this timeframe will allow the collection process to commence legally.

- Get professional assistance in understanding the possible remedies available and to decide on the most appropriate solution.

- Engage with SARS within the time limit specified on the letter of demand, in writing and with professional guidance, applying one of the remedies that are legally allowed.

- Follow through on all the required steps for each remedy. For example, it is not sufficient to lodge an objection – a Request for Suspension of Payment must also be submitted to delay debt collection until the objection is finalised.

- The winning strategy remains ongoing and verified compliance. Check the Statements of Account for the various tax categories on a regular basis.