“The employment tax incentive is aimed at encouraging employers to hire young and less experienced work seekers.” (SARS Employers ETI Guide)

With Youth Day celebrations around the corner, business owners have an opportunity not only to consider unlocking the benefits of having young workers in their teams, but also to make a difference to South Africa’s dismal youth employment rate.

What are the benefits of hiring young employees?

- More likely to be technologically savvy, younger employees have a positive impact on the adoption and use of new software and technology in a company.

- They also give companies that target the millennial market an advantage, as they can reach and communicate with their peers.

- Wages for young employees are lower, making them the cost-effective choice for entry-level positions, freeing up experienced workers for strategic level work.

- Younger people are better equipped to respond to sudden change and unexpected circumstances.

- Companies have an opportunity to develop a workforce specifically trained to meet their business needs and culture.

- Young workers bring paradigm shifting ideas, fresh perspectives and different ways of thinking and working to their organisations.

- Youthful energy, enthusiasm and creativity are great for team building, productivity and workplace morale.

- Used to formal learning, young people tend to absorb training more readily.

- Most young workers are eager to learn, build their experience and apply their skills.

Source: Unicef

One option businesses should consider to enable them to take on more young workers into their companies is to use the ETI incentive from SARS.

What is ETI?

The Employment Tax Incentive (ETI) is a tax concession encouraging employers to hire more young people aged between 18 and 29 years. It reduces the employer’s cost of hiring young people through a cost-sharing mechanism with government while leaving the earnings received by the employee unaffected.

This incentive offers a wide benefit. Employers are financially incentivised to hire more young people, and young people gain valuable work skills and experience, benefiting the wider economy.

It complements existing government programmes with similar objectives e.g. learnership agreements, and it will be available until 28 February 2029.

Who qualifies for ETI?

- Employers who:

- are registered for Employees’ Tax (PAYE)

- are tax compliant

- meet these qualifying criteria on an ongoing basis.

It is however important to note that certain employers (e.g. those in the national, provincial or local sphere of government and certain public entities) are specifically excluded from utilising the ETI.

- Employees who:

- have a valid South African ID or permit

- are aged between 18 and 29 years old

- earn between minimum wage or R2000 and R6500 for a 160-hour month

- who are not domestic workers or “connected persons” to their employers

- meet these qualifying criteria on an ongoing basis.

Employers operating within a Special Economic Zone will, provided they meet certain criteria, not be subject to the age limitation highlighted in the second bullet.

How does ETI work?

ETI can be claimed for a 24-month period for all employees who qualify. The monthly value for the ETI reduces the amount of Pay-As-You-Earn (PAYE) due by the company and is claimed by correctly completing the ETI field on the employer’s monthly EMP201.

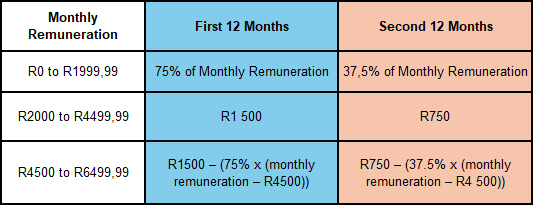

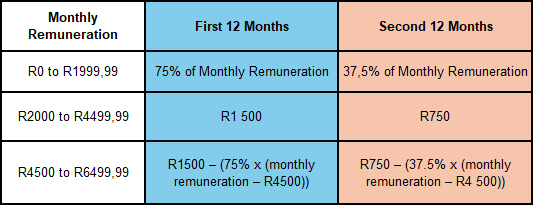

The value of the incentive amount is not static but depends on the value of the monthly remuneration paid to the qualifying employee and must be calculated each month for each qualifying employee using the table below.

Source: SARS

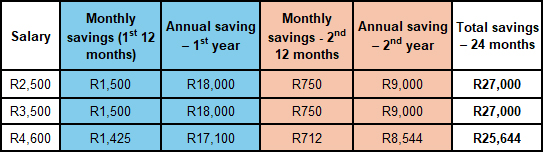

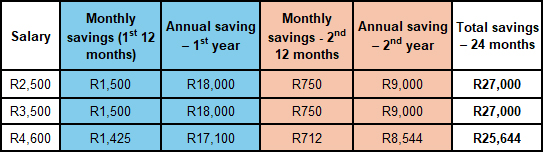

Examples of ETI savings

The amount of the rebate reduces in the second 12-month period. In addition, as the monthly remuneration increases, the amount of the rebate reduces: at the upper limit with a monthly remuneration of R6400, the monthly rebate is just R75 per month.

The ETI can only be claimed in the months in which the employee was a qualifying employee (i.e. the employee may, due to the remuneration paid to them, be a qualifying employee in the first three months but not in the fourth and fifth months. If the employee is a qualifying employee in the sixth month, the sixth month is month number four as far as the 12-month period is concerned). Further to the above, should the number of hours worked by the employee in the relevant month be less than 160 hours, the ETI claimed is to be apportioned accordingly.

However, there is no limit to the number of qualifying employees for which a company can claim ETI, and especially in labour-intensive environments, these rebates will add up on a monthly basis, and certainly stack up over two years.

Claiming the incentive may however not result in the employer’s EMP201 monthly declaration reflecting a negative amount. Should this be the case, the employer should reflect a net PAYE amount of R Nil.

ETI pitfalls

- If an employer claims ETI for any employee who does not qualify, penalties equal to 100% of the ETI claimed will apply.

- Penalties imposed will result in under-payment of PAYE, which will attract interest and penalties.

- Companies cannot displace existing employees to employ a worker who qualifies for the ETI – a penalty of R30 000 will be levied for each employee so displaced.

- Meticulous recordkeeping is required by the ETI Act.

- Companies may face time-consuming and costly verifications and audits of their ETI claims.

How to take advantage of this incentive

When correctly calculated and administered, ETI is a significant opportunity for businesses, especially smaller companies, and those with large labour forces, to scale their activities at potentially lower costs.

Sadly, many small companies are not taking advantage of this incentive, and according to research done by Sage, the top reasons include concerns surrounding increased admin and a fear of claiming ETI incorrectly.

We are ready and able to assist you to determine whether ETI is suitable for your business and to correctly calculate and administer this tax benefit for you, ensuring your business can enjoy all the benefits of young workers as well as a potentially substantial tax reduction over the next two years.