“The two-pot system is meant to support long-term retirement savings while offering flexibility to help fund members in financial distress.” (National Treasury)

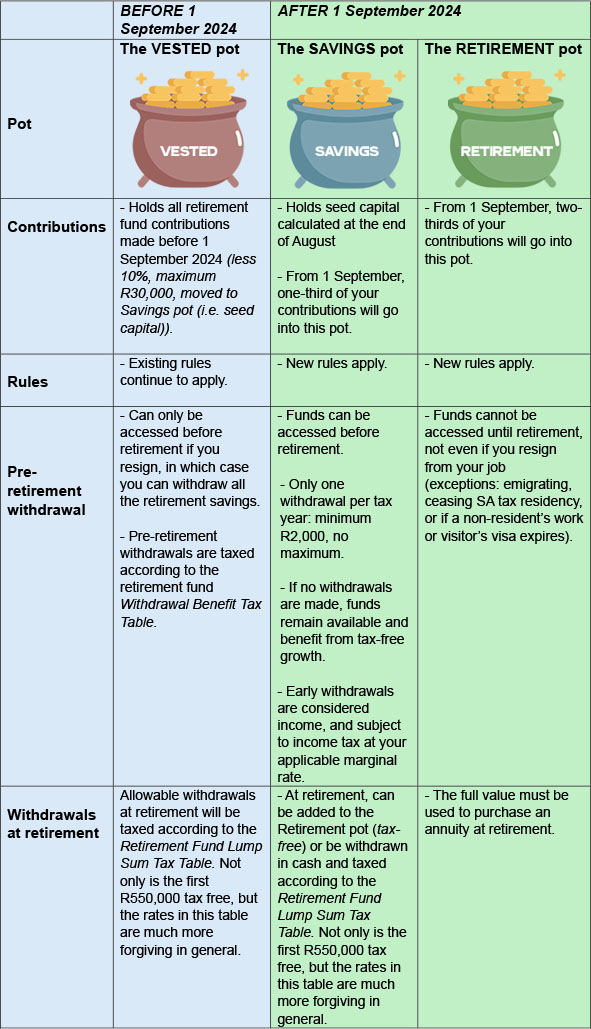

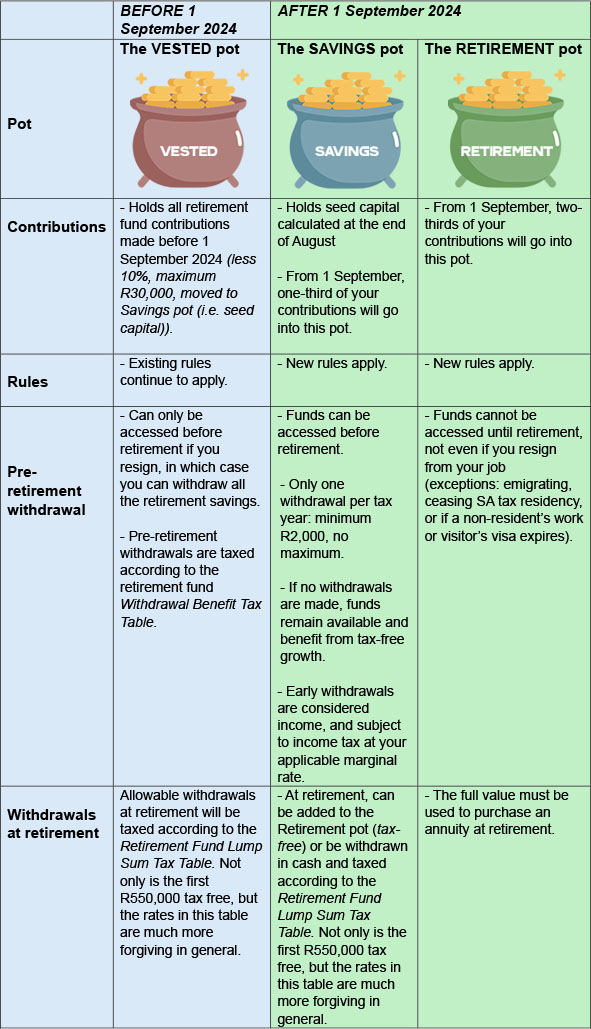

The three pots of the new retirement system

Tax and other issues

Withdrawing from any of the pots should be approached with caution. In addition to the fees that will be charged, and the potentially devastating impact on your eventual retirement savings, there are also tax implications that must be carefully considered.

- It’s significantly more expensive from a tax perspective to withdraw retirement funds before retirement age (normally 55), because the Withdrawal Benefit Tax Table or Individual’s Tax Table will apply. Instead, waiting until retirement to access savings – when the Retirement Fund Lump Sum Benefits or Severance Benefits Tax Table applies – is a far better tax option.

- Up to R550,000 drawn as a cash lump sum at retirement may be tax free. However, this R550,000 is a cumulative withdrawal total over your lifetime. That means this tax benefit could be eroded by pre-retirement withdrawals.

- Transfers from the Vested and Savings pots into the Retirement pot are also tax-free.

- Employer contributions are still treated as taxable fringe benefits.

- Early withdrawals from your Savings pot are considered income and are subject to income tax as per the tax directive the fund manager will request from SARS. What’s more, any outstanding taxes you owe SARS will automatically be deducted if you make a withdrawal.

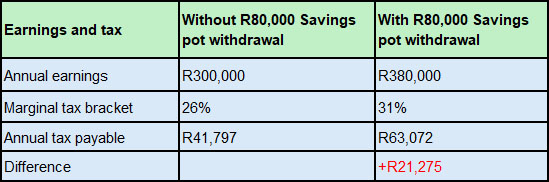

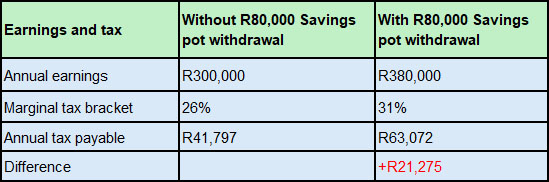

- Depending on your annual income and the amount withdrawn, a pre-retirement withdrawal from your Savings pot – taxed at your individual marginal tax rate – could also push you into a higher tax bracket. This would mean paying more tax on all your income for the year. Here’s an example of the potential impact of withdrawing R80,000 from your Savings pot. Waiting until retirement age to withdraw the same amount could be tax-free.

Hidden costs of early withdrawals

Your full retirement fund contribution (one-third Savings pot; two-thirds Retirement pot) is still tax deductible up to 27.5% of annual income, up to a maximum R350,000 per tax year. This remains one of the biggest tax breaks out there, but is effectively cancelled out by the tax payable on an early withdrawal. Early withdrawals also have another cost – the loss of tax-free growth that could have been earned on your savings.

Continuing with the example above, if the R80,000 is not withdrawn, but instead left to grow at an average annual return of 10% for 25 years, the projected returns are R866,776 (equivalent to R201,958 in today’s terms assuming 6% inflation). This means you could lose tax-free growth of R121,958 by withdrawing just R80,000!

Help is at hand!

Understanding the tax and other implications of early retirement fund withdrawals in the short term and at retirement will help you to make better-informed financial decisions.

Early retirement fund withdrawals are likely to be more expensive in tax and lost investment growth compared to other options such as overdraft facilities, credit cards or home loans.