Quick Tips for Preventing Time Fraud

“Fraud and deceit are anxious for your money. Be informed and prudent” (John Andreas Widtsoe, scientist, author and religious leader)

While accountants have become adept at spotting and preventing financial fraud simply by analysing a company’s books, there is another kind of fraud that needs alert leadership, record keeping and careful analysis to completely snuff out. Time fraud sounds like a concept from a sci-fi movie, but in reality, it’s actually quite a simple concept. Like with those who commit regular fraud, a time fraudster is purposefully stealing from the company, but what they are stealing is a much less tangible asset – time.

Time fraud is any kind of employee behaviour that knowingly steals time from a company. It could be as minor as taking an extra smoke break, or purposefully arriving late, but can also involve using extended company time for side projects, and even illegally clocking in for shifts that weren’t worked.

The 10-10-80 rule of business fraud says that 10% of employees will never cheat a company, 80% will cheat a company under the right circumstances and 10% are always actively looking for ways to cheat the company. This means that if it is unchecked time fraud can become a companywide problem that chokes profitability, irritates customers and destroys team morale. Here are our tips for making sure it doesn’t destroy your company.

Spotting time fraud

- Recognising the red flags

Detecting time fraud is about watching patterns. An employee who comes in late occasionally is not a fraudster, one who comes in late every day just might be. Catching a time fraudster therefore requires you to pay close attention to the employee’s behaviour. Sometimes honest employees can be guilty of one or more of these things, dependent on their skill level or job requirements, but if they are adding up, you are likely looking at a thief.

Is the employee regularly claiming they worked long hours, but getting very little done? Do they frequently miss deadlines? Are there inconsistencies in their time tracking or billable hours records? What are the employee’s colleagues saying about their efforts?

- The fraud triangle

Fraud criminologist Donald R. Cressey has developed what he calls the Fraud triangle, a tool businesses can use to determine which employees are most likely to commit any kind of fraud, including time theft.

As the name suggests, the fraud triangle asks managers to pay particular attention to employees who exhibit any of these three components:

- Motivation: People with motivation to commit time fraud are more likely to do it. Motivation covers a wide range of incentives from the receptionist with a new boyfriend she loves chatting to on the phone, to the ambitious go-getter who is trying to start their own side-hustle.

- Opportunity: Opportunity is much more common now when so many people work from home. Employees who would be able to indulge in time fraud without comment are much more likely to infringe.

- Rationalisation: Again, employees who are able to rationalise their time theft are much more likely to do it. For example, if they believe the 30minutes they leave early each day isn’t missed by the company.

How to prevent time fraud

- Communicate concerns

Because of the 10-10-80 rule and the fraud triangle, preventing 80% of time fraud generally revolves around simply removing people’s opportunity to commit time fraud and their ability to rationalise it. Write up clear policies and procedures on time fraud and ensure that these are shared regularly with the team to show it does matter to you and that you are on top of it.Your communications should also show the downsides to time fraud such as overtime for teams to meet deadlines, bad relationships with clients and declining profitability which could lead to layoffs. Stripped of their ability to rationalise their theft, 80% of people will stop engaging in any time fraud and others will be incentivised to report colleagues who do still engage.

- Monitor your employees

Monitoring employees sounds very 1984, but it does not have to be onerous and does not require micromanagement. It can be as simple as installing cameras at the entrance of the building or asking your managers to make a simple note each time an employee is absent, late or misses a deadline.It is important to keep a record of these things so that if it is ever necessary to meet up with an errant employee there is some kind of record of their wrongdoing to show them they are being watched.

- Audits and analysis

When an employee becomes suspicious you may have to take things to the next level and begin auditing their time. Check what time they logged in, when they had their meetings and whether they were using their company laptops for something other than their work, by looking at their internet search history. Provided your employees bill by the hour, your accountant will be able to create resources that compare the fraudster with their colleagues to accurately gauge how much time is going missing.Those who fail audits should be invited to time management training and be advised that if their behaviour does not correct itself, there may be consequences.

At the end of the day, those who are determined to scam the system will find ways to do it. For these employees nothing short of hearings with the threat of eventual dismissal will likely work to prevent their behaviour. If, however, you simply implement the rules above, the 10-10-80 rule suggests that 80% of all time fraud should vanish, leading to a much more productive, happy and profitable company.

Use This SARS Incentive to Bring Young People into Your Business

“The employment tax incentive is aimed at encouraging employers to hire young and less experienced work seekers.” (SARS Employers ETI Guide)

With Youth Day celebrations around the corner, business owners have an opportunity not only to consider unlocking the benefits of having young workers in their teams, but also to make a difference to South Africa’s dismal youth employment rate.

What are the benefits of hiring young employees?

- More likely to be technologically savvy, younger employees have a positive impact on the adoption and use of new software and technology in a company.

- They also give companies that target the millennial market an advantage, as they can reach and communicate with their peers.

- Wages for young employees are lower, making them the cost-effective choice for entry-level positions, freeing up experienced workers for strategic level work.

- Younger people are better equipped to respond to sudden change and unexpected circumstances.

- Companies have an opportunity to develop a workforce specifically trained to meet their business needs and culture.

- Young workers bring paradigm shifting ideas, fresh perspectives and different ways of thinking and working to their organisations.

- Youthful energy, enthusiasm and creativity are great for team building, productivity and workplace morale.

- Used to formal learning, young people tend to absorb training more readily.

- Most young workers are eager to learn, build their experience and apply their skills.

Source: Unicef

One option businesses should consider to enable them to take on more young workers into their companies is to use the ETI incentive from SARS.

What is ETI?

The Employment Tax Incentive (ETI) is a tax concession encouraging employers to hire more young people aged between 18 and 29 years. It reduces the employer’s cost of hiring young people through a cost-sharing mechanism with government while leaving the earnings received by the employee unaffected.

This incentive offers a wide benefit. Employers are financially incentivised to hire more young people, and young people gain valuable work skills and experience, benefiting the wider economy.

Who qualifies for ETI?

- Employers who:

- are registered for Employees’ Tax (PAYE)

- are tax compliant

- meet these qualifying criteria on an ongoing basis.

- Employees who:

- have a valid South African ID or permit

- are aged between 18 and 29 years old

- earn between minimum wage or R2000 and R6500 for a 160-hour month

- who are not domestic workers or “connected persons” to their employers

- meet these qualifying criteria on an ongoing basis.

Employers operating within a Special Economic Zone will, provided they meet certain criteria, not be subject to the age limitation highlighted in the second bullet.

How does ETI work?

ETI can be claimed for a 24-month period for all employees who qualify. The monthly value for the ETI reduces the amount of Pay-As-You-Earn (PAYE) due by the company and is claimed by correctly completing the ETI field on the employer’s monthly EMP201.

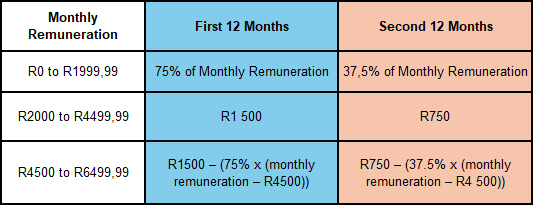

The value of the incentive amount is not static but depends on the value of the monthly remuneration paid to the qualifying employee and must be calculated each month for each qualifying employee using the table below.

Source: SARS

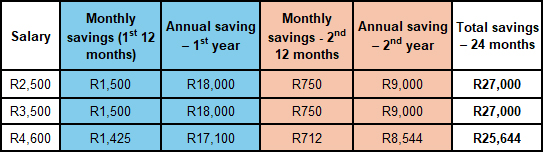

Examples of ETI savings

The amount of the rebate reduces in the second 12-month period. In addition, as the monthly remuneration increases, the amount of the rebate reduces: at the upper limit with a monthly remuneration of R6400, the monthly rebate is just R75 per month.

The ETI can only be claimed in the months in which the employee was a qualifying employee (i.e. the employee may, due to the remuneration paid to them, be a qualifying employee in the first three months but not in the fourth and fifth months. If the employee is a qualifying employee in the sixth month, the sixth month is month number four as far as the 12-month period is concerned). Further to the above, should the number of hours worked by the employee in the relevant month be less than 160 hours, the ETI claimed is to be apportioned accordingly.

However, there is no limit to the number of qualifying employees for which a company can claim ETI, and especially in labour-intensive environments, these rebates will add up on a monthly basis, and certainly stack up over two years.

Claiming the incentive may however not result in the employer’s EMP201 monthly declaration reflecting a negative amount. Should this be the case, the employer should reflect a net PAYE amount of R Nil.

ETI pitfalls

- If an employer claims ETI for any employee who does not qualify, penalties equal to 100% of the ETI claimed will apply.

- Penalties imposed will result in under-payment of PAYE, which will attract interest and penalties.

- Companies cannot displace existing employees to employ a worker who qualifies for the ETI – a penalty of R30 000 will be levied for each employee so displaced.

- Meticulous recordkeeping is required by the ETI Act.

- Companies may face time-consuming and costly verifications and audits of their ETI claims.

How to take advantage of this incentive

When correctly calculated and administered, ETI is a significant opportunity for businesses, especially smaller companies, and those with large labour forces, to scale their activities at potentially lower costs.

Sadly, many small companies are not taking advantage of this incentive, and according to research done by Sage, the top reasons include concerns surrounding increased admin and a fear of claiming ETI incorrectly.

We are ready and able to assist you to determine whether ETI is suitable for your business and to correctly calculate and administer this tax benefit for you, ensuring your business can enjoy all the benefits of young workers as well as a potentially substantial tax reduction over the next two years.

Your Tax Deadlines for May 2024

- 07 May – PAYE submissions and payments

- 24 May– Value-Added Tax (VAT) manual submissions and payments

- 30 May – Excise duty payments

- 31 May – VAT electronic submissions and payments, & Corporate Income Tax (CIT) Provisional Tax payments where applicable